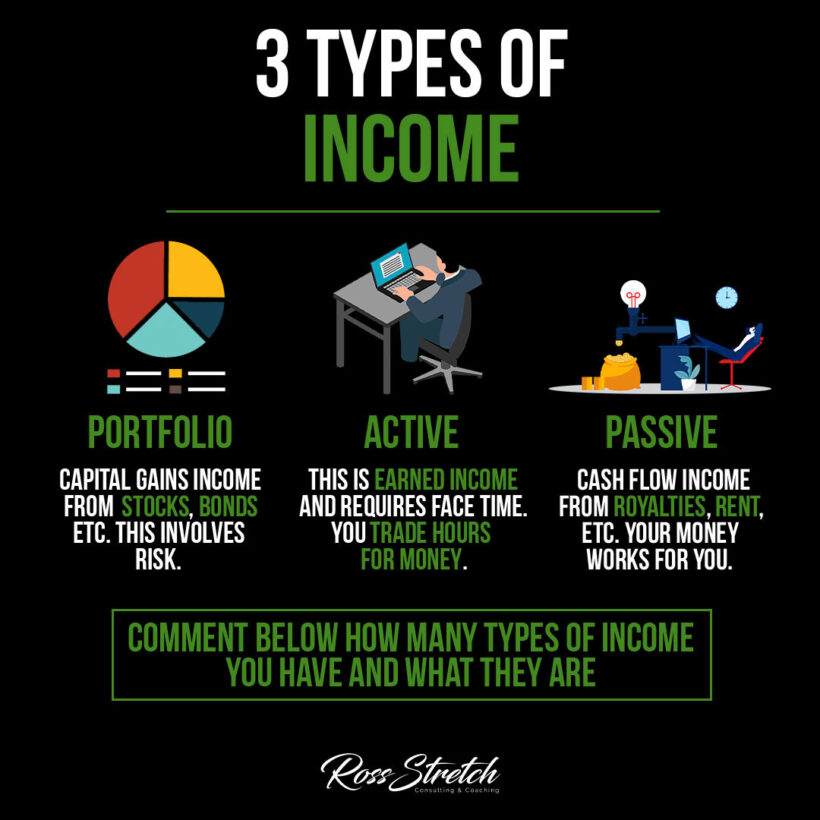

Understanding the different types of income is essential for financial planning and building long-term wealth. Each income type—active, portfolio, and passive—contributes differently to your financial goals, and diversifying your income sources can increase financial security. Here’s a detailed guide to the three types of income and how they work.

1. Active Income: Trading Hours for Money

Active income, also known as earned income, is money you receive in exchange for time and effort. This is the most common type of income and includes wages, salaries, and freelance earnings. Most people rely on active income to meet their daily expenses, but it has limitations, as it requires continuous work to maintain.

- Examples of Active Income Sources:

- Salaried Jobs: Fixed payments received on a regular basis, often with benefits like health insurance.

- Hourly Wages: Payment based on the number of hours worked, common in part-time and freelance roles.

- Freelancing and Consulting: Payment for services provided on a project or hourly basis.

- Pros and Cons of Active Income:

- Pros: Predictable and stable, offers immediate returns for work.

- Cons: Limited by the number of hours available to work, can lead to burnout, no income if you’re not working.

While active income provides stability, it often lacks scalability, meaning it may not be sufficient for long-term wealth-building alone.

2. Portfolio Income: Earning from Investments

Portfolio income is generated from investments, typically in the form of capital gains or dividends from assets like stocks, bonds, and other securities. Portfolio income involves some risk, as its value can fluctuate with market conditions, but it also offers potential for growth.

- Examples of Portfolio Income Sources:

- Stocks and Bonds: Investments in company stocks or government bonds that can appreciate in value or pay dividends.

- Mutual Funds and ETFs: These funds pool money from multiple investors to invest in diversified portfolios of stocks and bonds.

- Real Estate Investment Trusts (REITs): Investments in real estate portfolios that pay dividends from rental income.

- Pros and Cons of Portfolio Income:

- Pros: Potential for capital appreciation, often outpaces inflation, diversified sources reduce risk.

- Cons: Market risk, requires initial capital, may need professional management.

Portfolio income can grow wealth over time and is an essential component of a well-rounded financial strategy, but it requires some knowledge of markets and investment strategies.

3. Passive Income: Money Working for You

Passive income is income earned with little to no active involvement once the initial setup is complete. It provides a steady cash flow that requires minimal effort to maintain, allowing you to earn even when you’re not actively working. Passive income is popular among those seeking financial independence, as it provides flexibility and freedom.

- Examples of Passive Income Sources:

- Rental Income: Income from leasing out property, such as real estate or vehicles.

- Royalties from Creative Work: Income from books, music, or online courses that generate revenue over time.

- Affiliate Marketing and Blogging: Earnings from promoting products or services through blogs, YouTube, or social media.

- Pros and Cons of Passive Income:

- Pros: Provides financial freedom, scalable, requires minimal ongoing effort once established.

- Cons: Initial setup can be time-consuming or costly, income may fluctuate.

With the right passive income sources, you can achieve greater financial independence, enabling you to prioritize personal pursuits over constant work.

4. How to Diversify Your Income for Financial Stability

Relying on just one type of income can be risky, as unexpected events like job loss or market downturns can impact your earnings. Diversifying income streams by incorporating all three types—active, portfolio, and passive—can improve financial resilience and help you reach your goals faster.

- Steps to Diversify Your Income:

- Start with Active Income: Secure a stable job or freelancing gig as a foundation for your income.

- Invest in Portfolio Income: Gradually allocate funds to stocks, bonds, or other assets that generate capital gains.

- Develop Passive Income Streams: Create or invest in assets that provide recurring income, such as rental properties, royalties, or online courses.

By balancing these income types, you reduce dependency on any one source and create multiple paths toward financial growth.

5. Building a Long-Term Wealth Strategy with Multiple Income Types

Each type of income serves a specific purpose in wealth-building. Active income supports daily expenses, portfolio income grows your wealth, and passive income provides freedom and flexibility. Here’s how to integrate each type into a cohesive financial strategy.

- Use Active Income to Fund Investments:

- Set aside a portion of your paycheck to build a portfolio, buying stocks, bonds, or other appreciating assets. Automating investments can help you stay consistent.

- Leverage Portfolio Income to Reinvest or Diversify:

- Dividends and capital gains from your portfolio can be reinvested to increase your wealth or allocated to new passive income opportunities.

- Focus on Scaling Passive Income:

- As passive income grows, you may eventually replace a portion of your active income. This offers financial freedom and allows for career flexibility or early retirement.

By strategically using each type of income, you can develop a well-rounded financial plan that provides both stability and growth opportunities.

Conclusion

Understanding the three types of income—active, portfolio, and passive—is essential for financial growth and independence. Active income supports daily needs, portfolio income builds wealth, and passive income grants freedom. By diversifying your income across these types, you create a stable and flexible financial foundation that aligns with long-term goals. Start with active income, invest to generate portfolio income, and eventually expand to passive income for a complete wealth-building strategy.