Introduction:

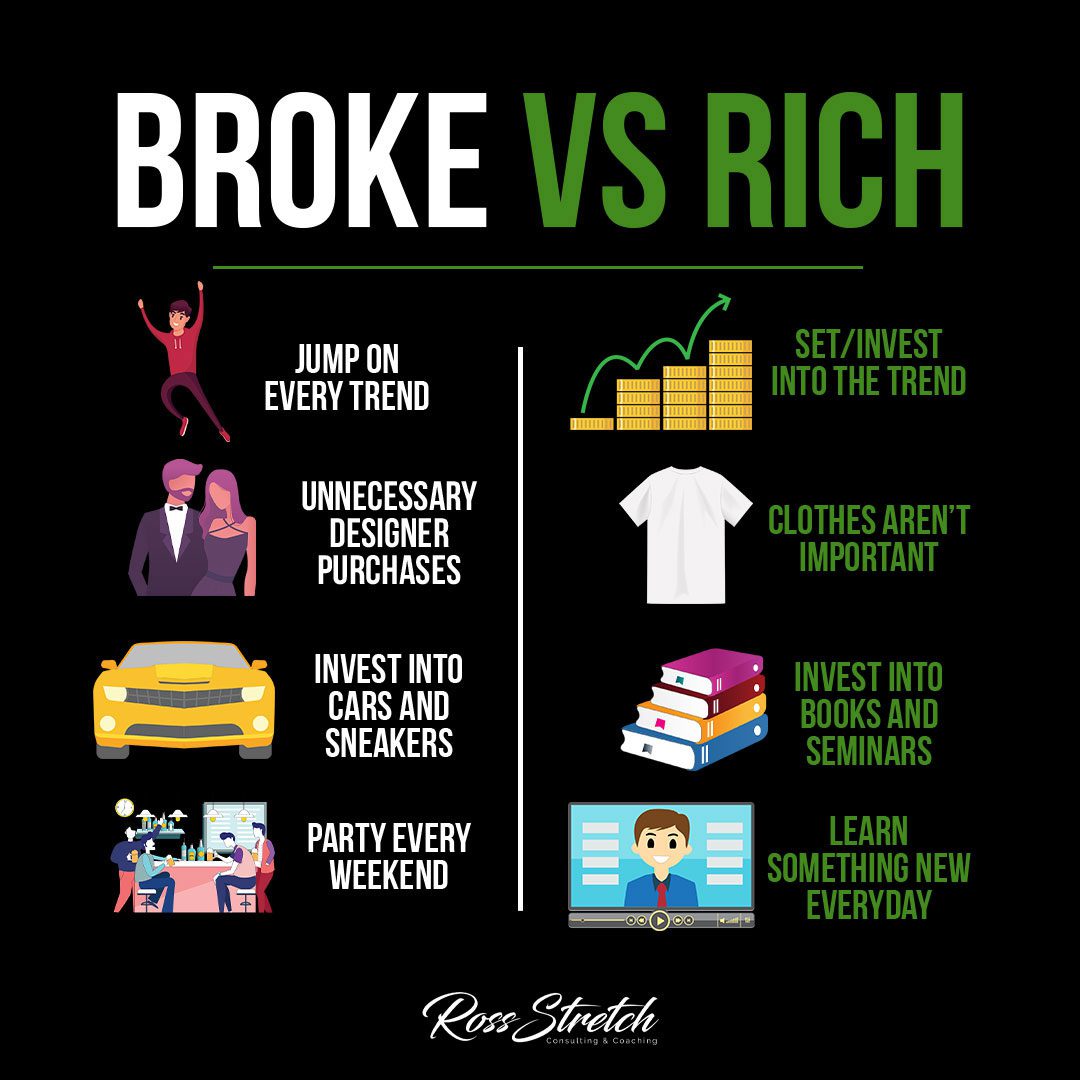

The journey from broke to rich requires more than just financial success. It’s about adopting the right mindset and making smart choices. In this infographic, we explore the stark differences between a broke and rich mindset, shedding light on the habits and practices that can make or break your path to wealth. From avoiding unnecessary trends and designer purchases to investing in knowledge and personal growth, this article reveals the secrets to building lasting wealth.

Distinguishing between a broke and rich mentality is crucial for achieving financial stability and building lasting wealth.

Ross Stretch

Jump on Every Trend

Broke mentality:

Many people who are struggling financially feel the need to keep up with every trend, often leading to impulsive purchases and unnecessary expenses. They may believe that owning the latest gadgets, fashion items, or lifestyle products will bring them happiness and validation.

- Succumbing to peer pressure: Broke individuals may feel compelled to fit in with their social circle or society’s expectations, leading to a constant cycle of trying to keep up with ever-changing trends.

- Financial strain: Chasing every trend can result in a significant drain on finances, as the costs of constantly purchasing new items accumulate over time.

- Lack of discernment: Broke individuals may prioritize immediate gratification over long-term financial stability, failing to differentiate between passing fads and valuable investments.

Rich mentality:

The rich understand the importance of distinguishing between fleeting trends and enduring value. They prioritize long-term investments and financial stability over short-term indulgence.

- Focus on long-term goals: Rather than being swayed by every passing trend, the rich focus on their financial objectives and invest their resources wisely.

- Evaluate the value proposition: Before making a purchase, the rich consider the long-term value and utility of the product or service. They prioritize quality, functionality, and sustainability over temporary trends.

- Seek timeless and versatile options: The rich often opt for classic and versatile items that withstand the test of time, allowing them to maintain a stylish and functional lifestyle without constantly chasing after the latest fads.

Unnecessary Designer Purchases

Broke mentality:

Broke individuals may prioritize material possessions and indulge in unnecessary luxury purchases, often as a means to impress others or elevate their social status.

- Seeking validation through possessions: For those struggling financially, designer labels and luxury items can become symbols of success and validation, offering a temporary sense of self-worth.

- Financial strain: Splurging on unnecessary designer purchases can lead to significant credit card debt or financial instability, as the costs of these items often far exceed one’s budget.

- Prioritizing appearances over financial well-being: Broke individuals may prioritize external perceptions and the desire to fit in, neglecting their long-term financial health.

Rich mentality:

The rich understand that true wealth is built through smart financial choices and strategic investments, rather than through material possessions alone.

- Focus on value and quality: Instead of blindly chasing designer brands, the rich prioritize investments that generate long-term returns, such as real estate, stocks, or businesses.

- Financial security: The rich focus on building a solid financial foundation, diversifying their investments, and making calculated decisions that align with their overall wealth-building strategy.

- Conscious spending: The rich evaluate the necessity and long-term value of luxury purchases, avoiding impulsive buying and focusing on investments that contribute to their financial goals.

Invest in Cars and Sneakers

Broke mentality:

Broke individuals may allocate a significant portion of their income to purchasing expensive cars and limited edition sneakers, often viewing these items as status symbols or instant sources of validation.

- Prioritizing material possessions: For those struggling financially, owning high-end cars or rare sneakers can serve as a way to boost their self-esteem or gain social recognition.

- Ignoring long-term financial implications: The costs associated with luxury vehicles and limited edition sneakers can be substantial, leaving little room for savings, investments, or long-term financial security.

- Failure to differentiate between assets and liabilities: Broke individuals may view these items as assets when, in reality, they are often liabilities that depreciate in value over time.

Rich mentality:

The rich understand the importance of making strategic investments that generate income or appreciate in value, focusing on assets that contribute to their overall wealth-building objectives.

- Asset-based thinking: Rather than splurging on depreciating assets, the rich prioritize investments that generate income, appreciate in value, or provide long-term financial security.

- Diversification and wealth preservation: The rich allocate their resources strategically, diversifying their investments across different asset classes to minimize risk and maximize potential returns.

- Prioritize cash flow: The rich understand the importance of generating passive income and building cash flow, enabling them to sustain their lifestyle and invest in future opportunities.

Party Every Weekend

Broke mentality:

Broke individuals may prioritize short-term enjoyment and indulge in frequent parties and entertainment, often without considering the long-term financial consequences.

- Seeking immediate gratification: Individuals struggling financially may turn to regular partying and entertainment as a way to escape their financial worries and enjoy the present moment.

- Neglecting financial responsibilities: Regular partying can lead to overspending, neglecting bills and financial obligations, and hindering progress towards long-term financial goals.

- Failing to establish financial stability: By prioritizing immediate pleasure, broke individuals may find it challenging to save money, invest in their future, or build a strong financial foundation.

Rich mentality:

The rich understand the importance of balancing enjoyment with responsible financial habits and prioritizing long-term financial stability.

- Budgeting and moderation: The rich create budgets that allow for occasional enjoyment without compromising their overall financial goals.

- Seeking cost-effective alternatives: Instead of frequent parties at expensive venues, the rich explore free or low-cost community events, host gatherings at home, or engage in activities that provide entertainment without excessive costs.

- Long-term financial planning: The rich recognize that financial stability and wealth accumulation require discipline, and they prioritize building savings, investments, and wealth-generating assets over short-lived pleasures.

Conclusion:

Distinguishing between a broke and rich mentality is crucial for achieving financial stability and building lasting wealth. By avoiding unnecessary trends, designer purchases, and impulsive spending, you can redirect your resources towards investments that generate long-term value. Additionally, prioritizing knowledge, personal growth, and continuous learning over material possessions allows you to develop skills and insights that contribute to your financial success. Adopting a rich mindset involves making conscious financial decisions, balancing present enjoyment with long-term goals, and investing in assets that appreciate or generate income. By breaking free from the traps of a broke mentality, you can pave the way for a more prosperous future.