Introduction: Explore the tax benefits

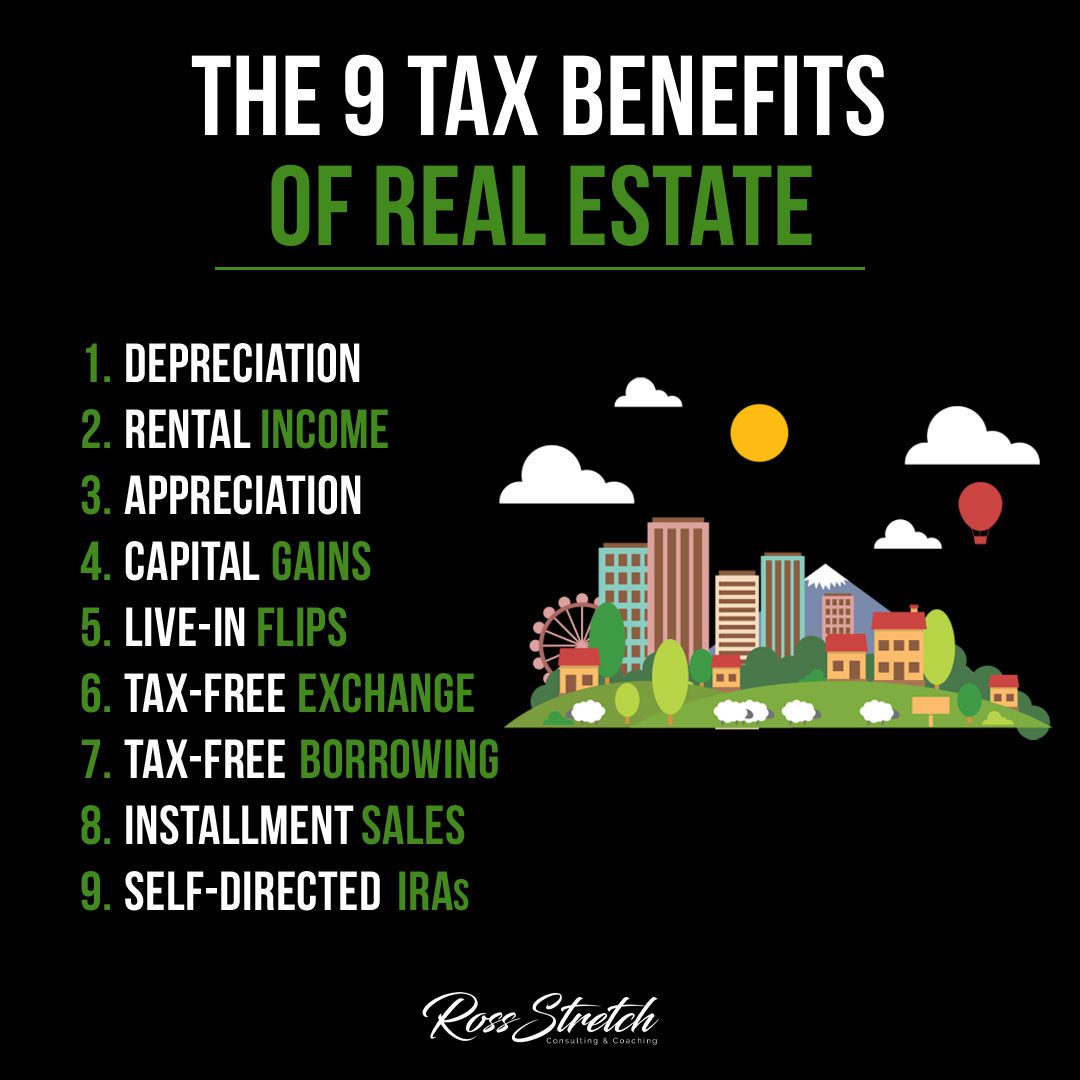

Investing in real estate can be a lucrative endeavor, offering not only potential financial gains but also various tax benefits. Understanding and utilizing these tax advantages can significantly impact your investment returns and overall financial strategy. In this comprehensive guide, we will delve into the nine tax benefits of real estate, providing insights into how they work and how you can maximize their advantages. From depreciation and rental income to tax-free exchanges and self-directed IRAs, let’s explore the tax benefits that real estate investors can leverage to their advantage.

From depreciation and rental income deductions to capital gains deferrals and self-directed IRAs, leveraging these tax advantages can significantly impact your bottom line.

Ross Stretch

Depreciation:

Depreciation is one of the most significant tax benefits of owning real estate. It allows you to deduct a portion of the property’s value over its useful life as a business expense. Here’s how depreciation works:

- Depreciation deduction: You can deduct a percentage of the property’s value each year as a non-cash expense, reducing your taxable income.

- Accelerated depreciation: Some types of real estate, such as commercial properties, may qualify for accelerated depreciation methods, allowing for larger deductions in the earlier years of ownership.

- Cost segregation: By allocating costs to specific components of a property, such as fixtures and improvements, you can accelerate depreciation deductions further.

Rental Income:

Rental income from real estate properties can offer significant tax advantages. Here’s how rental income impacts your tax situation:

- Rental income deductions: You can deduct various expenses related to owning and operating rental properties, such as mortgage interest, property taxes, insurance, repairs, and property management fees.

- Passive activity loss rules: Real estate rental activities may qualify as passive income, allowing you to offset rental income with passive losses from other investments.

Appreciation:

Real estate investments have the potential to appreciate over time, leading to increased property value. While appreciation does not offer immediate tax benefits, it can impact your tax situation in the following ways:

- Capital gains tax: When you sell a property for a profit, you may be subject to capital gains tax. However, long-term capital gains rates are typically lower than ordinary income tax rates, providing tax advantages.

- Step-up in basis: If you hold onto a property until your passing, your heirs will receive a step-up in basis, potentially minimizing capital gains tax liability.

Capital Gains:

Capital gains tax is applicable when you sell a property for a profit. Understanding the tax implications of capital gains can help you make informed investment decisions:

- Long-term vs. short-term capital gains: Holding a property for more than one year qualifies you for long-term capital gains tax rates, which are typically lower than short-term rates.

- 1031 Exchange: By utilizing a 1031 exchange, you can defer capital gains taxes by reinvesting the proceeds from a property sale into a like-kind property.

Live-in Flips:

Live-in flips refer to purchasing a property, living in it for a period, and then selling it for a profit. This strategy offers potential tax benefits:

- Primary residence exclusion: If you live in a property as your primary residence for at least two out of the last five years before selling, you may qualify for a tax exclusion on the capital gains (up to a certain limit).

Tax-Free Exchange:

A tax-free exchange, also known as a like-kind exchange or a Section 1031 exchange, allows you to defer capital gains taxes by exchanging one investment property for another. Here’s how it works:

- Like-kind properties: The exchanged properties must be of the same nature, such as residential for residential or commercial for commercial.

- Qualified intermediary: You must use a qualified intermediary to facilitate the exchange and meet specific timing requirements.

Tax-Free Borrowing:

Real estate investors can benefit from tax-free borrowing through various strategies, such as refinancing or taking out home equity loans. Here’s how tax-free borrowing can be advantageous:

- Mortgage interest deductions: The interest paid on mortgages or home equity loans used for investment purposes may be tax-deductible, reducing your taxable income.

Installment Sales:

An installment sale allows you to spread out the tax liability from selling a property over multiple years. This can provide tax advantages by deferring the recognition of the entire gain in one tax year.

- Deferred tax payments: With an installment sale, you only recognize a portion of the gain each year as you receive payments from the buyer.

Self-Directed IRAs:

Investing in real estate through a self-directed Individual Retirement Account (IRA) offers tax advantages, particularly for those seeking alternative investment options. Here’s how it works:

- Tax-deferred growth: Income and gains generated from real estate investments within a self-directed IRA grow tax-deferred, allowing for potential compound growth over time.

- Tax-free distributions: If you have a Roth self-directed IRA, qualified distributions from real estate investments can be tax-free.

Conclusion:

Understanding the tax benefits of real estate investments is crucial for maximizing returns and optimizing your financial strategy. From depreciation and rental income deductions to capital gains deferrals and self-directed IRAs, leveraging these tax advantages can significantly impact your bottom line. As with any tax-related matters, it’s essential to consult with a tax professional or advisor to ensure compliance and make informed decisions tailored to your specific circumstances.

Resources:

- IRS: irs.gov

- BiggerPockets: biggerpockets.com

- Investopedia: investopedia.com