Introduction

The aspiration to get rich quickly is common among the younger generation, especially those in their twenties. However, true financial success is rarely instant. It requires a combination of financial savvy, discipline, and diversification of income. This guide provides actionable insights into achieving wealth in your twenties by adopting a strategic and disciplined approach.

Creating multiple streams of income can enhance financial security and accelerate wealth accumulation.

Ross Stretch

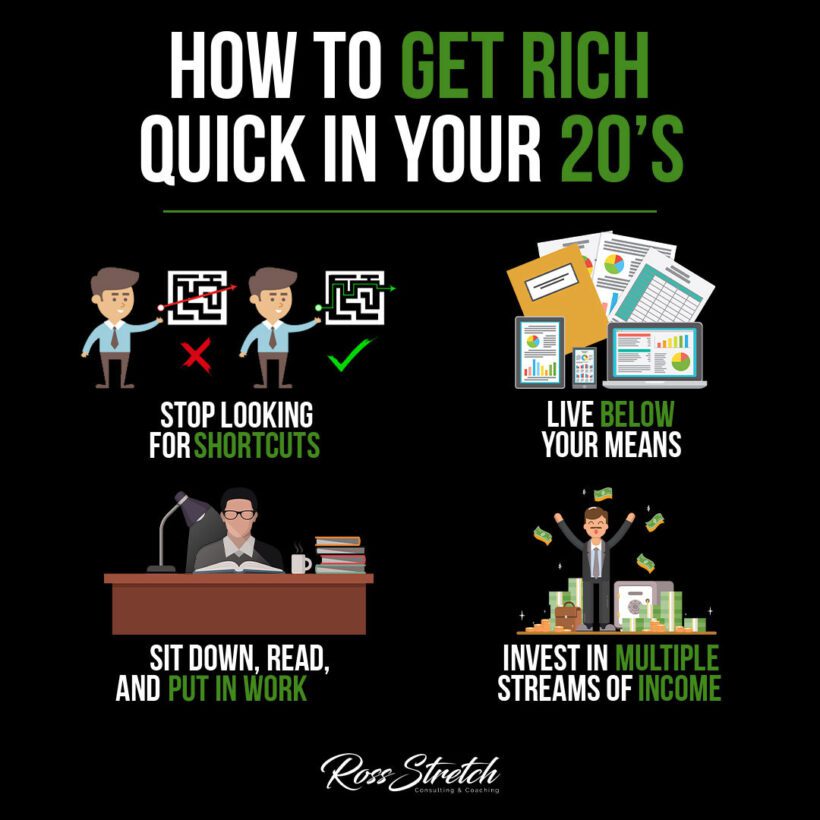

Rejecting the Shortcut Mentality

Wealth-building is a marathon, not a sprint. The first step is to discard the illusion of shortcuts and accept that wealth comes from consistent hard work, smart planning, and patience. Quick fixes often lead to short-lived success or, worse, financial setbacks.

Embracing Financial Education

A solid understanding of financial principles is crucial. In your twenties, investing time in learning about personal finance, investing, and the market economy can set the foundation for wise decision-making. Books, podcasts, and financial courses can be invaluable resources.

The Power of Frugality

Living below your means is not about deprivation; it’s about prioritization. By managing expenses and avoiding unnecessary debt, you can allocate more resources toward savings and investments, which can compound over time.

Investing in Yourself

Your twenties are an ideal time to invest in your education and skills. This investment can pay off significantly in terms of career advancement and income opportunities. Additionally, embracing a strong work ethic and seeking out mentorship can accelerate your journey to financial success.

Diversifying Income Streams

Relying on a single source of income is a risky strategy. Creating multiple streams of income can enhance financial security and accelerate wealth accumulation. This can include side hustles, freelance work, investing in stocks or real estate, or starting a business.

The Role of Saving and Investing

Developing the habit of saving a portion of your income is fundamental. But saving alone is not enough; you must also learn to invest wisely. Whether it’s through retirement accounts, stocks, or other investment vehicles, your money needs to grow through smart, well-researched investments.

Avoiding Debt Traps

Debt can be a significant barrier to wealth-building. Avoiding high-interest debt, particularly from credit cards or loans for depreciating assets, is essential. When used strategically, however, certain debts can be beneficial, like those for education or investment in appreciating assets.

Networking and Community Building

Building a strong network can open doors to opportunities that may lead to wealth creation. Networking isn’t just about professional connections; it’s about creating a community of support, advice, and potential partnerships.

Monitoring Your Financial Health

Regularly monitoring your financial progress is key to staying on track. This means setting financial goals, budgeting, and using tools to track your income, savings, and investments.

Conclusion

Getting rich quick is an alluring concept, but the reality is that wealth is usually the result of a series of smart decisions made consistently over time. By focusing on financial education, living frugally, investing in oneself, diversifying income streams, and avoiding debt, those in their twenties can set a strong foundation for financial success.