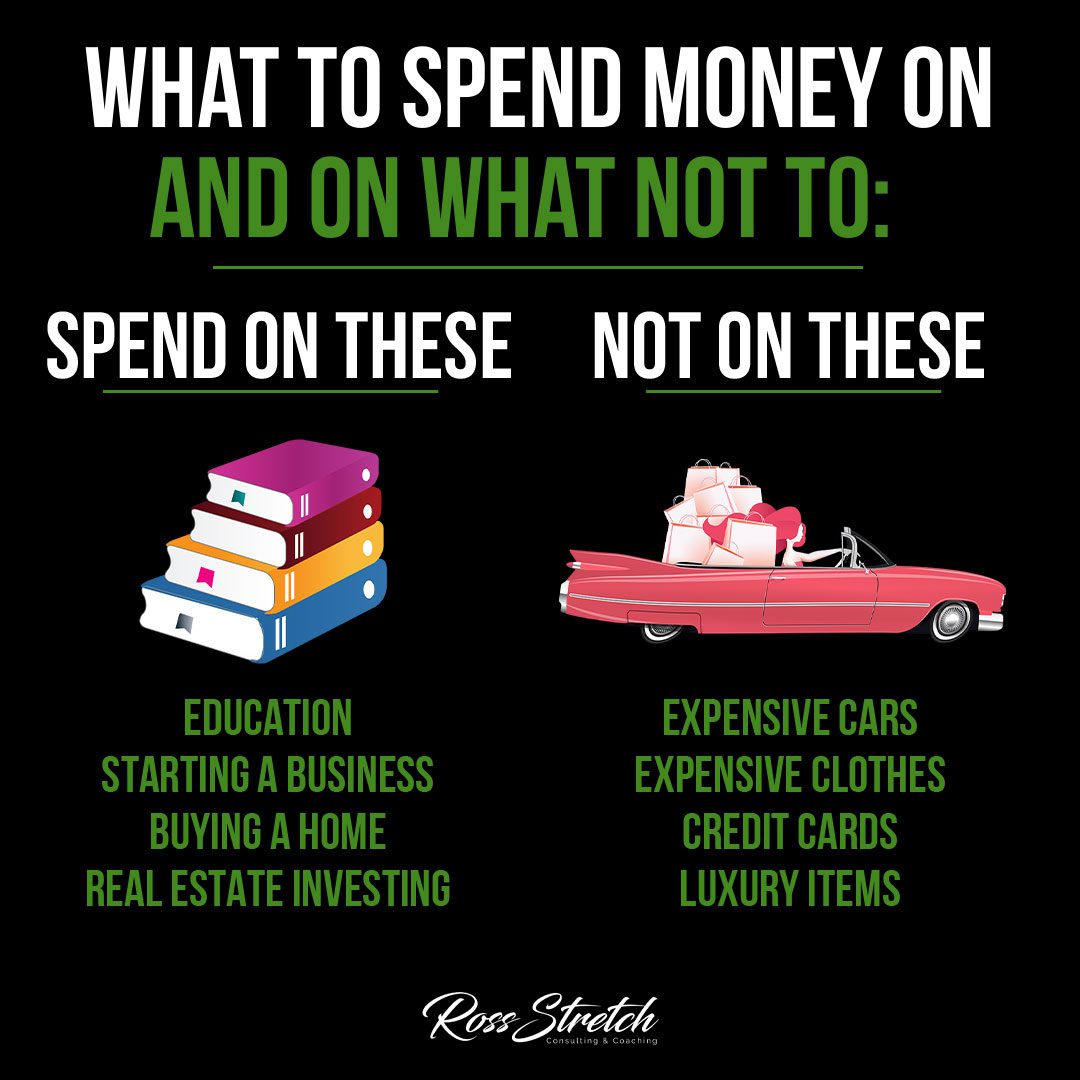

Spend on These

Education

Investing in education is one of the most valuable ways to spend your money. Acquiring knowledge and skills can open doors to better career opportunities and higher earning potential. Whether it’s pursuing a college degree, attending vocational training, or enrolling in professional development courses, investing in education can yield long-term financial rewards.

Starting a Business

Entrepreneurship offers an excellent opportunity to invest your money wisely. Starting a business allows you to leverage your skills and passion to generate income and build wealth. However, it’s crucial to conduct thorough market research and create a solid business plan to increase your chances of success. By investing in your own business, you have the potential to enjoy significant financial returns and achieve financial independence.

Buying a Home

Purchasing a home can be a wise investment, as it provides both a place to live and potential long-term financial benefits. Real estate tends to appreciate over time, building equity and serving as a valuable asset. However, careful consideration should be given to factors such as location, market conditions, and affordability. By making informed decisions and investing in a home, you can create a stable foundation for your financial future.

Real Estate Investing

Real estate investing offers a wealth-building opportunity beyond owning a primary residence. By investing in rental properties or real estate investment trusts (REITs), you can generate passive income and enjoy potential appreciation in property value. It’s essential to conduct thorough research, understand the risks involved, and diversify your investments. Real estate investing can be a powerful tool for wealth creation when approached with knowledge and careful planning.

Luxury items, such as high-end gadgets, accessories, or extravagant vacations, can quickly drain your finances without providing long-term value.

Ross Stretch

Don’t Spend on These

Expensive Cars

While a reliable vehicle is necessary for transportation, investing in excessively expensive cars can be financially burdensome. Luxury cars often come with high purchase prices, maintenance costs, and depreciation rates. Instead, prioritize a car that meets your transportation needs without stretching your budget. Consider factors such as fuel efficiency, reliability, and long-term affordability.

Expensive Clothing

While it’s natural to desire fashionable clothing, spending excessively on designer labels can strain your finances. Prioritize quality, timeless pieces that can be mixed and matched, rather than chasing fleeting trends. Look for sales, shop at thrift stores, and consider second-hand options to save money without compromising your style. Remember, it’s the confidence and personality that make an outfit shine, not the price tag.

Credit Cards

Avoid excessive reliance on credit cards and accumulating high-interest debt. While credit cards can provide convenience and rewards, they should be used responsibly. Aim to pay off your credit card balances in full each month to avoid interest charges. Establish a budget, track your spending, and use credit cards as a tool for building credit and managing expenses, rather than as a source of impulsive spending.

Luxury Items

Luxury items, such as high-end gadgets, accessories, or extravagant vacations, can quickly drain your finances without providing long-term value. Instead, focus on experiences and investments that contribute to your overall well-being and financial security. Prioritize experiences that create lasting memories, such as travel that enriches your cultural understanding or investing in experiences that promote personal growth and development.

In conclusion

Making smart spending choices is crucial for achieving financial success. Invest in education, starting a business, buying a home, and real estate to build a solid financial foundation. Avoid wasteful spending on expensive cars, clothing, credit cards, and luxury items that offer little long-term value. By making informed decisions and prioritizing investments that align with your financial goals, you can secure a prosperous future and enjoy the benefits of financial independence. Remember, wise spending habits are key to unlocking your financial potential and creating a life of stability and abundance.