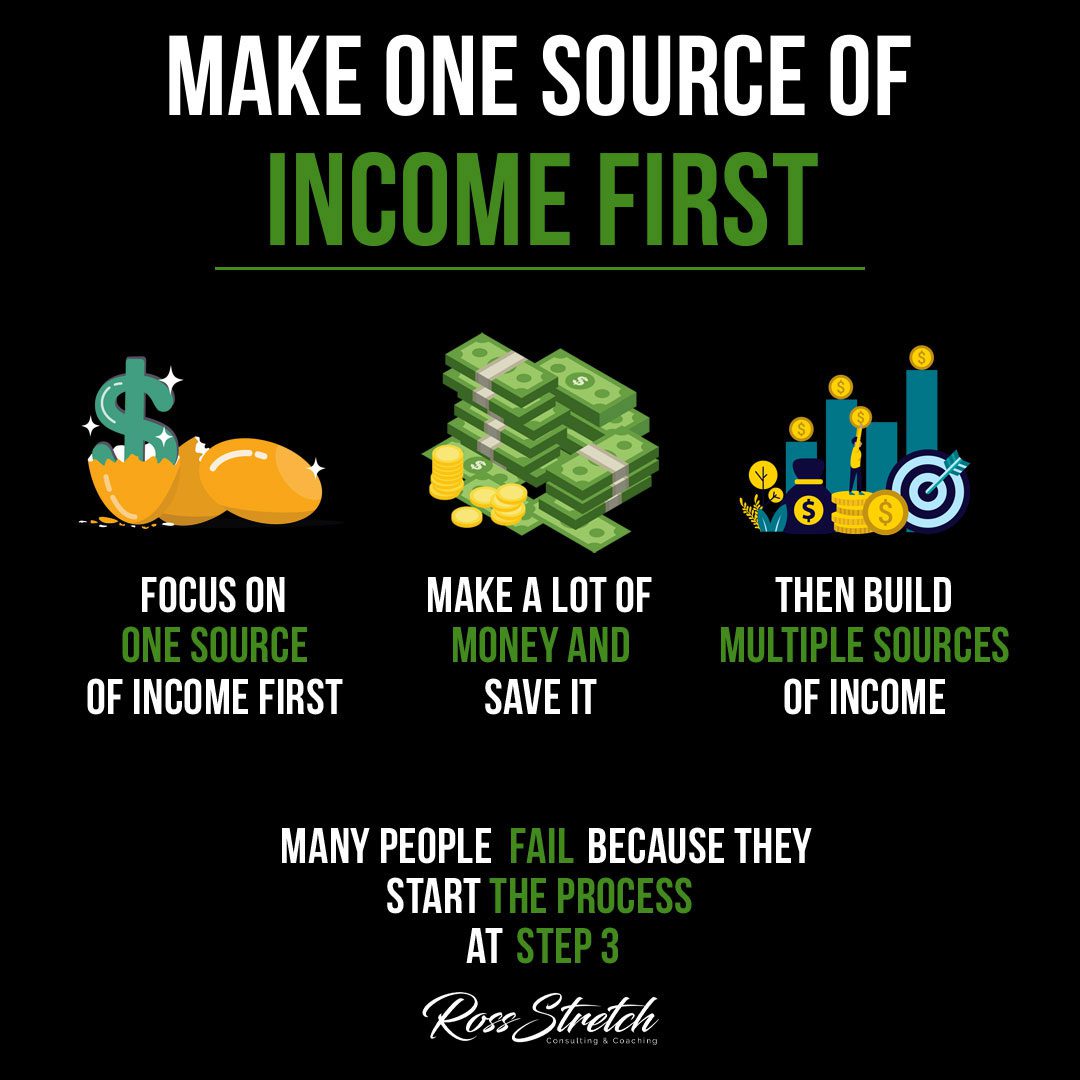

When it comes to building wealth, the journey typically begins with a single step: establishing one stable source of income. It’s an approach echoed by financial advisors and wealth management experts alike. The roadmap to financial independence is not about immediate diversification but rather about deepening and strengthening one income stream before adding more to the portfolio.

Focus on One Source of Income First

The first phase in the journey toward financial security is to focus on one source of income. This stage is about growth and stability. It’s where you hone your skills, build your brand, or establish a loyal customer base.

Strategies for Focusing on a Single Income:

- Develop expertise in your chosen field.

- Streamline business processes for efficiency.

- Invest in marketing to build a strong presence in your niche.

Saving: The Keystone of Financial Growth

Once a stable income is flowing, the next critical step is saving. Accumulating savings provides a safety net and the necessary capital to invest in future income streams.

Tips for Effective Saving:

- Set aside a fixed percentage of your income regularly.

- Cut unnecessary expenses to boost your savings rate.

- Consider high-yield savings accounts for better returns on your savings.

Building Multiple Income Streams

After establishing a robust initial income and saving diligently, the next logical step is diversification. Building multiple sources of income can provide financial security and resilience.

Pathways to Multiple Income Streams:

- Invest in financial instruments like stocks or bonds.

- Use savings to fund a start-up or a new business venture.

- Explore passive income opportunities like rental properties or royalties.

The Pitfall: Skipping Steps

A common mistake that many make is jumping straight to diversification. Without a solid foundation, this can lead to overextension and financial strain.

Avoiding Common Mistakes:

- Resist the urge to diversify too quickly.

- Ensure your primary income source is stable and sustainable.

- Build a financial buffer before investing in new ventures.

Conclusion: A Methodical Path to Financial Freedom

The path to financial freedom is more marathon than sprint. By focusing on establishing one strong income source, saving effectively, and only then diversifying your income, you lay down a methodical path to wealth. It’s a strategy that requires patience, discipline, and foresight but promises a more secure financial future.