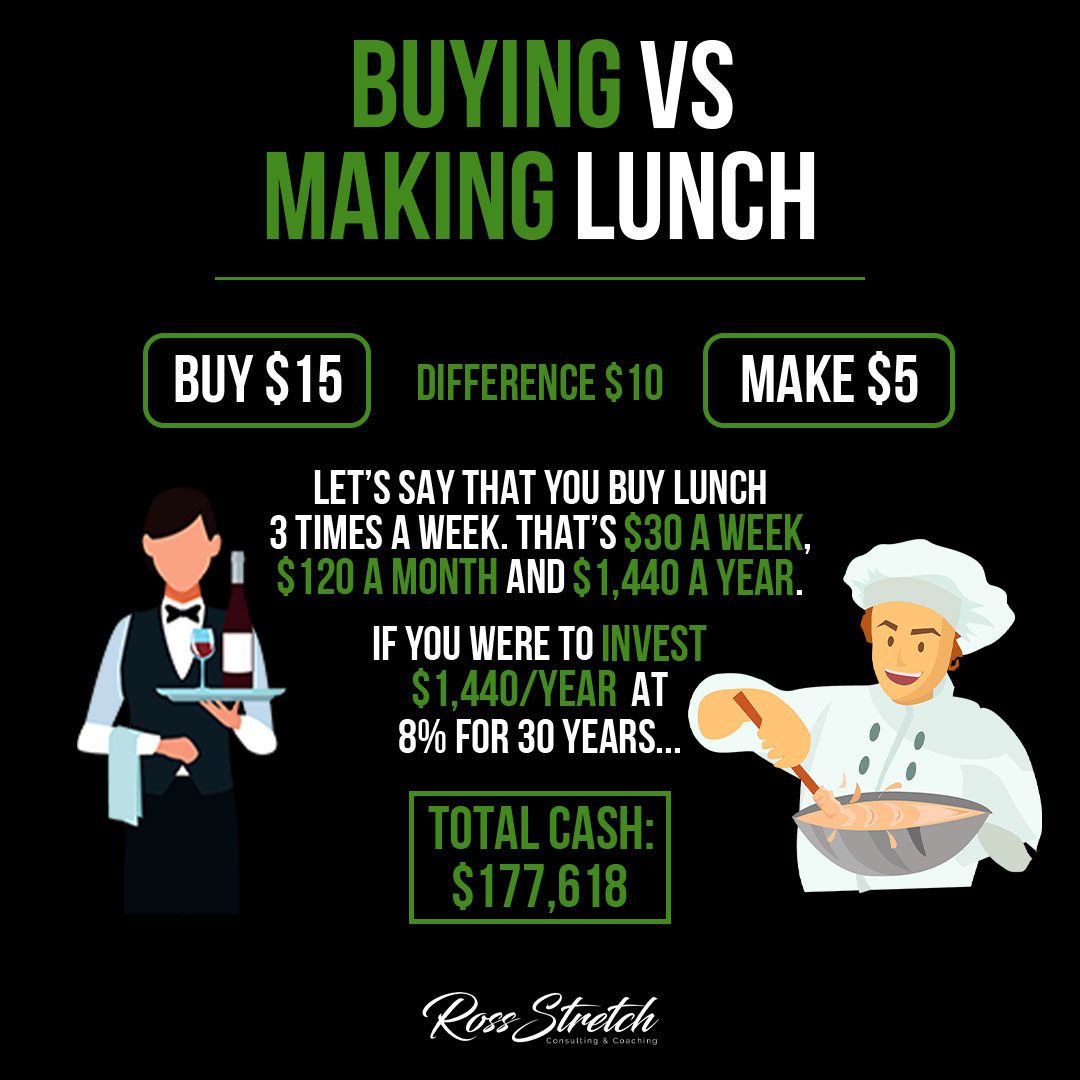

Buy for $15 or Make for $5: A Difference of $10

Financial Implications of Lunch Choices

The decision between buying lunch or making lunch can have a significant impact on your finances. Let’s delve into the numbers to understand the cost disparity and the potential long-term benefits of making your own meals.

Calculating the Daily Savings

Assuming that buying lunch costs around $15 per day while making lunch costs only $5, the difference amounts to a considerable $10. This may seem like a small amount on a daily basis, but it accumulates over time.

Let’s Say That You Buy Lunch 3 Times a Week: That’s $30 a Week, $120 a Month, and $1440 a Year

Multiplying the Costs

If you typically buy lunch three times a week, the expenses quickly add up. At $15 per meal, you would be spending $45 weekly, which equates to $180 per month and a substantial $2,160 per year.

The Impact of Annual Costs

By investing $2,160 per year at an 8% annual return over a longer period, you can see the potential for significant financial growth. Let’s explore how these savings can translate into substantial wealth over time.

If You Were to Invest $1440/Year at 8% for 30 Years, That Would Total $177,618 Cash

The Power of Compound Interest

By redirecting the $2,160 yearly expenditure towards investments that generate an 8% annual return, your money can grow significantly over a 30-year period. Through the magic of compound interest, you can accumulate a substantial sum.

Long-Term Wealth Accumulation

If you were to invest $1,440 annually for 30 years at an 8% return, the total amount would reach an impressive $177,618 in cash. This potential wealth is the result of wise financial choices and consistent saving habits.

Making the Most of Your Money

Embracing Financial Savvy

Choosing to make your own lunch instead of buying can have a profound impact on your financial well-being. By redirecting the money saved into investments with reasonable returns, you can set yourself up for long-term financial success.

Tips for Saving and Investing

To maximize your savings and investment potential, consider these tips:

- Plan your meals and make a shopping list to avoid unnecessary expenses.

- Invest in a quality lunch container to transport your homemade meals conveniently.

- Research different investment options to find the ones that align with your financial goals.

- Consult with a financial advisor for personalized guidance and advice.

In conclusion

The decision between buying lunch or making lunch may seem insignificant on a daily basis. However, when you consider the long-term financial implications, the difference becomes significant. By saving $10 a day through homemade lunches and investing the accumulated amount wisely, you have the potential to accumulate substantial wealth over time. By making conscious financial choices and embracing savvy money management, you can set yourself up for a financially secure future.