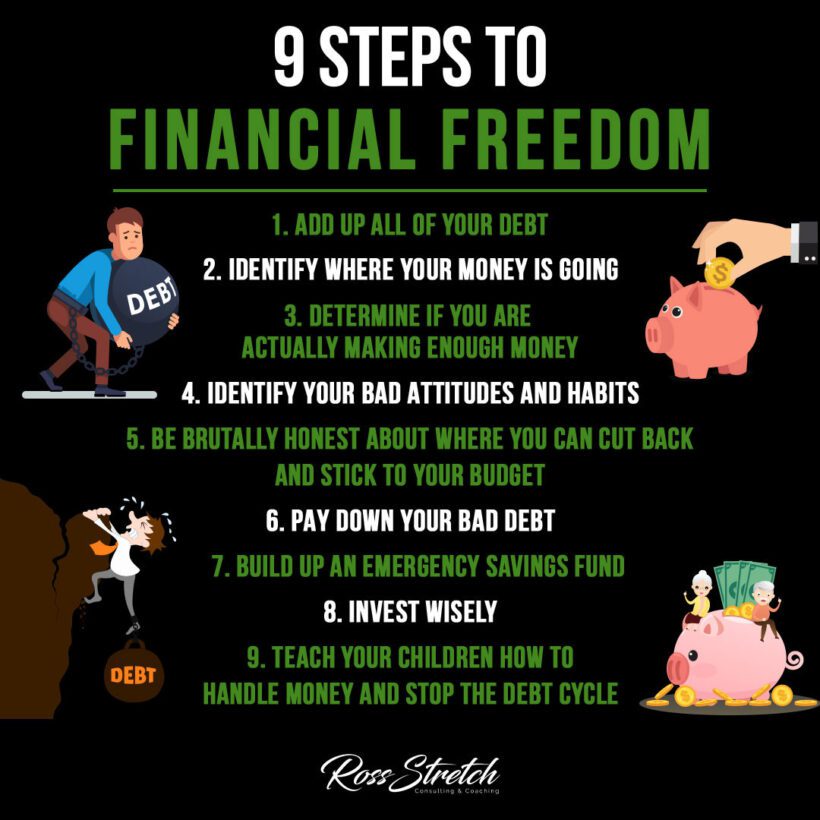

Financial freedom is a goal many aspire to, but it can seem elusive without a clear plan. Achieving it requires more than wishful thinking; it demands a strategic approach to managing your finances. Here are nine actionable steps you can take to navigate the path to financial independence.

Step 1: Facing Your Financial Reality

Begin by taking a hard look at your debt. List out everything you owe, from credit card balances to loans. This step is about confronting the numbers head-on and understanding the scope of what you’re dealing with.

Assessing Your Debt

Gather all your financial statements and record each debt. This gives you a complete picture and is the first step to taking control of your finances.

Step 2: Tracking Your Spending

Knowing where your money is going is crucial. Use budgeting apps or simple spreadsheets to track your spending patterns.

Budgeting with Purpose

Categorize your spending and identify areas where you can cut back. This insight allows you to redirect funds towards paying off debt.

Step 3: Evaluating Your Income

Assess whether your current income meets your financial needs and goals. If not, consider seeking additional income sources.

Increasing Your Earnings

Look for opportunities to increase your income, whether through promotions, side hustles, or new employment opportunities.

Step 4: Shifting Your Mindset

Your attitude towards money shapes your financial decisions. Identify any negative beliefs or habits that may be holding you back.

Cultivating a Positive Financial Mindset

Replace negative thoughts with empowering beliefs. Understand that money is a tool for achieving your goals, not an end in itself.

Step 5: Creating a Realistic Budget

Be brutally honest about where you can cut back on expenses. Develop a budget that aligns with your debt repayment and savings goals.

Sticking to Your Budget

Commit to your budget. Regularly review and adjust it as needed to stay on track with your financial goals.

Step 6: Eliminating Debt

Prioritize paying down high-interest debt first. Consider strategies like debt snowball or avalanche methods.

Debt Repayment Strategies

Choose a debt repayment strategy that works for you and stick with it until you’re debt-free.

Step 7: Building an Emergency Fund

Start small if necessary, but begin putting money aside for unexpected expenses. Aim for three to six months of living expenses.

The Importance of Liquid Savings

An emergency fund can prevent you from falling back into debt when unexpected costs arise.

Step 8: Investing for the Future

Once your debt is under control and you have an emergency fund, start investing. Research your options and consider seeking advice from a financial advisor.

Smart Investment Choices

Invest in a diversified portfolio to spread risk and maximize potential returns.

Step 9: Educating the Next Generation

Teach your children about money management and the importance of saving and investing to break the cycle of debt.

Fostering Financial Literacy in Children

Incorporate financial lessons into everyday activities and encourage savings habits early on.

In Conclusion: Financial Freedom Is Within Reach

Financial freedom isn’t an overnight achievement—it’s a journey. By following these nine steps, you can build a solid financial foundation and work towards a future where money is a tool for achieving your dreams, not a source of stress.