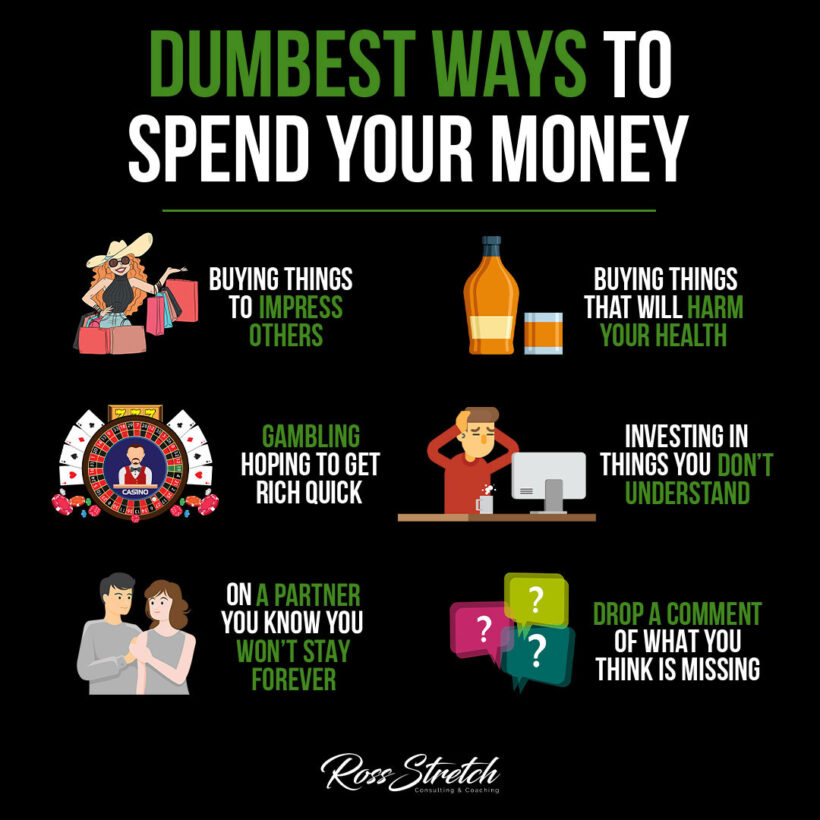

Money can be easy to waste, especially if we’re not careful. Some spending choices can hurt our finances and make it harder to reach our goals. Here are seven of the dumbest ways to spend your money and tips on avoiding these traps.

1. Buying Things to Impress Others

Spending money to look good in front of others is a common mistake. Whether it’s designer clothes, fancy cars, or the latest gadgets, trying to impress people can get expensive. Often, people we’re trying to impress don’t even notice or care.

- Why It’s a Waste: These purchases usually don’t add long-term value to your life.

- Better Choice: Spend on things that make you genuinely happy, not what you think others will like.

Instead of focusing on what others think, use your money to improve your own life.

2. Buying Things That Harm Your Health

Spending on things like cigarettes, excessive alcohol, or junk food can harm both your health and your wallet. These habits may seem small at first, but they add up over time and can lead to serious health costs.

- Why It’s a Waste: Unhealthy spending can lead to expensive medical bills later on.

- Better Choice: Invest in healthy habits, like exercise, good food, and wellness routines.

Choose items that benefit your health, helping you save money on future medical costs.

3. Gambling in Hopes of Getting Rich Quick

Gambling can feel exciting, but it’s an easy way to lose money fast. Most gambling games are designed to benefit the house, not the players. While winning may happen occasionally, gambling to get rich is a risky approach that often leads to losses.

- Why It’s a Waste: The odds are stacked against you, and you’re likely to lose more than you win.

- Better Choice: Save or invest your money in something with a better return.

Instead of gambling, put your money in savings or invest it for more secure returns.

4. Investing in Things You Don’t Understand

Investing can be a good way to grow wealth, but only if you know what you’re doing. Many people lose money by putting their cash into investments they don’t fully understand, like complex stocks, cryptocurrency, or speculative markets.

- Why It’s a Waste: Lack of knowledge often leads to poor decisions and financial losses.

- Better Choice: Do your research and only invest in things you understand well.

Learn the basics before investing, or consider consulting with a financial advisor for guidance.

5. Spending Money on a Partner You Won’t Stay With

When dating, it’s easy to spend money on gifts, trips, and fancy dates. But spending too much on a partner you’re not serious about can drain your finances quickly. While it’s nice to treat someone you care about, be mindful of your spending.

- Why It’s a Waste: If the relationship ends, you may regret the money spent.

- Better Choice: Focus on thoughtful, affordable gestures rather than expensive outings.

Consider setting a budget for dating and keep your finances in mind before big expenses.

6. Spending on Comments and Opinions

In today’s social media world, people often spend money just to get approval or comments from others. This can include buying new clothes for each post, paying for trendy items, or overspending to look popular online.

- Why It’s a Waste: It’s short-term satisfaction, with little to no real-life benefit.

- Better Choice: Post what makes you happy, without spending extra for others’ approval.

Remember that online likes and comments aren’t worth going into debt or stressing over money.

Conclusion

These seven habits are some of the worst ways to spend money. By avoiding these traps, you can save more, reduce stress, and reach your financial goals sooner. Be mindful of where your money goes, and make choices that improve your quality of life—not just your image.