Introduction

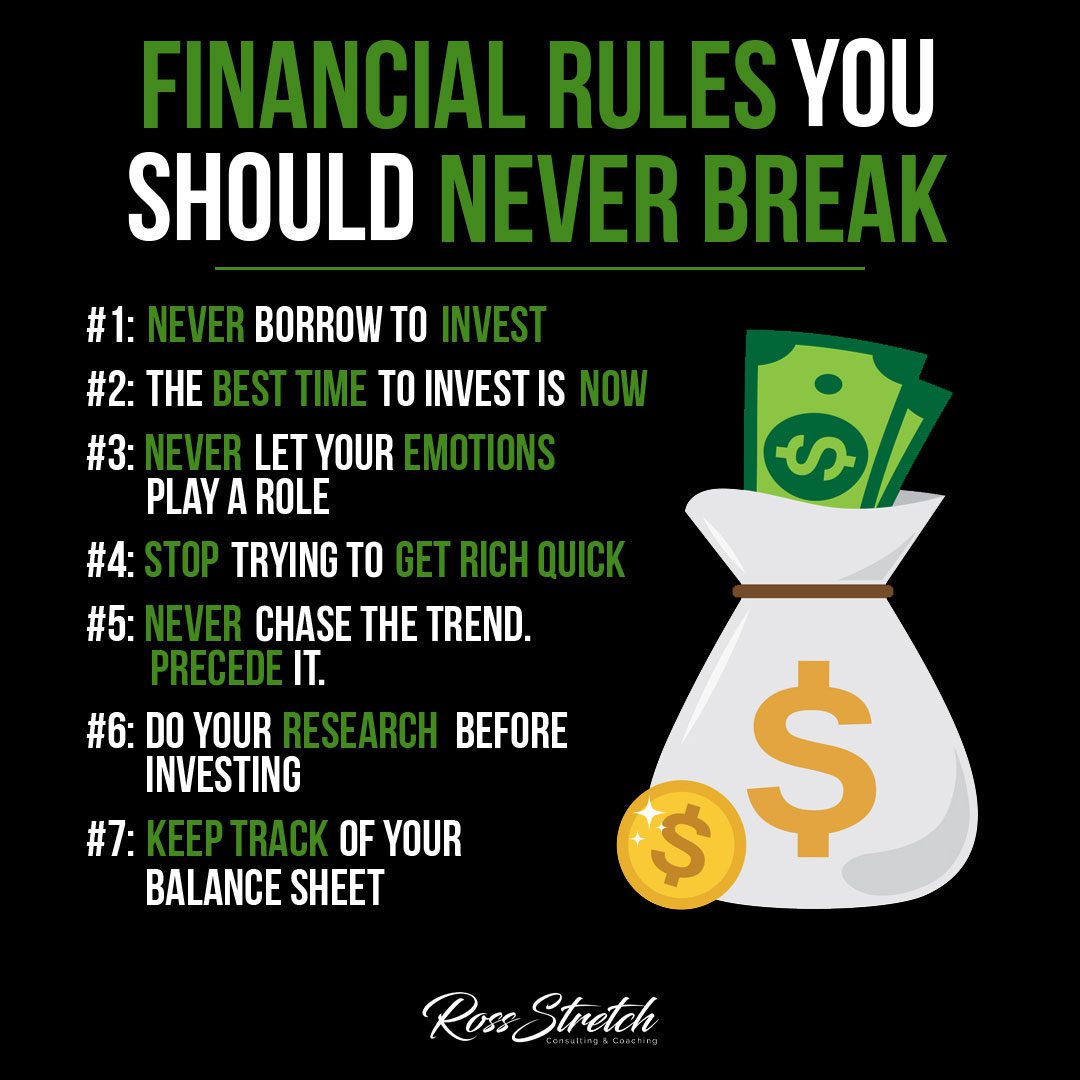

When it comes to managing your finances, following certain rules can make a significant difference in your long-term financial well-being. In this article, we will explore essential financial rules that you should never break. By adhering to these principles, you can make informed decisions, avoid common pitfalls, and build a solid financial foundation.

Following trends blindly in the financial market can be risky. Rather than chasing the latest fads, aim to predict market trends based on thorough research and analysis. Make informed investment decisions that align with your financial goals and risk tolerance.

Ross Stretch

Never Borrow to Invest

One of the cardinal rules of financial management is to avoid borrowing money to invest. While investing can offer potential returns, relying on borrowed funds increases your risk and may lead to financial instability. Instead, focus on saving and investing your own money to minimize debt and maximize your investment gains.

The Best Time to Invest is Now

Timing plays a crucial role in investment success. Rather than waiting for the perfect moment, understand that the best time to invest is now. The power of compounding works in your favor when you start early. Even small, regular investments can accumulate over time and yield substantial returns.

Never Let Your Emotions Play a Role

Emotions can cloud judgment, especially when it comes to financial decisions. Avoid making impulsive investment choices driven by fear or greed. Stick to your long-term financial plan and make decisions based on rational analysis and thorough research.

Stop Trying to Get Rich Quick

The pursuit of quick wealth often leads to unnecessary risks and potential losses. Avoid get-rich-quick schemes or investments promising extraordinary returns. Instead, focus on a disciplined approach, building wealth gradually through a well-diversified investment portfolio and consistent savings.

Never Chase the Trend, Predict It

Following trends blindly in the financial market can be risky. Rather than chasing the latest fads, aim to predict market trends based on thorough research and analysis. Make informed investment decisions that align with your financial goals and risk tolerance.

Do Your Research Before Investing

Before investing in any financial instrument, it’s crucial to conduct thorough research. Understand the investment vehicle, its potential risks and returns, and how it fits into your overall financial strategy. Seek advice from financial professionals if needed to make well-informed investment choices.

Keep Track of Your Balance Sheet

To maintain financial stability, it’s essential to keep track of your personal balance sheet. Regularly review your assets, liabilities, income, and expenses. By understanding your financial position, you can make informed decisions and adjust your strategy as needed.

Diversify Your Investments

Diversification is a key principle for minimizing risk. Spread your investments across different asset classes, industries, and geographic regions. This diversification helps protect your portfolio from downturns in specific sectors and maximizes your potential for long-term growth.

Save for Emergencies

Building an emergency fund is crucial for financial security. Aim to save at least three to six months’ worth of living expenses. This fund acts as a safety net during unexpected circumstances, such as job loss or medical emergencies, and prevents you from falling into debt.

Prioritize Debt Repayment

High-interest debt can hinder your financial progress. Make it a priority to repay outstanding debts, starting with those with the highest interest rates. By reducing your debt burden, you can free up funds for savings and investments, improving your overall financial health.

Seek Professional Advice When Needed

While it’s essential to educate yourself about personal finance, don’t hesitate to seek professional advice when necessary. Financial advisors can provide valuable insights, help you develop a comprehensive financial plan, and guide you towards your goals.

Conclusion

Following these financial rules can significantly impact your long-term financial well-being. From avoiding impulsive investments to staying informed and prioritizing debt repayment, these principles will help you make wise financial decisions. Remember, financial success is built on discipline, patience, and a commitment to long-term planning.