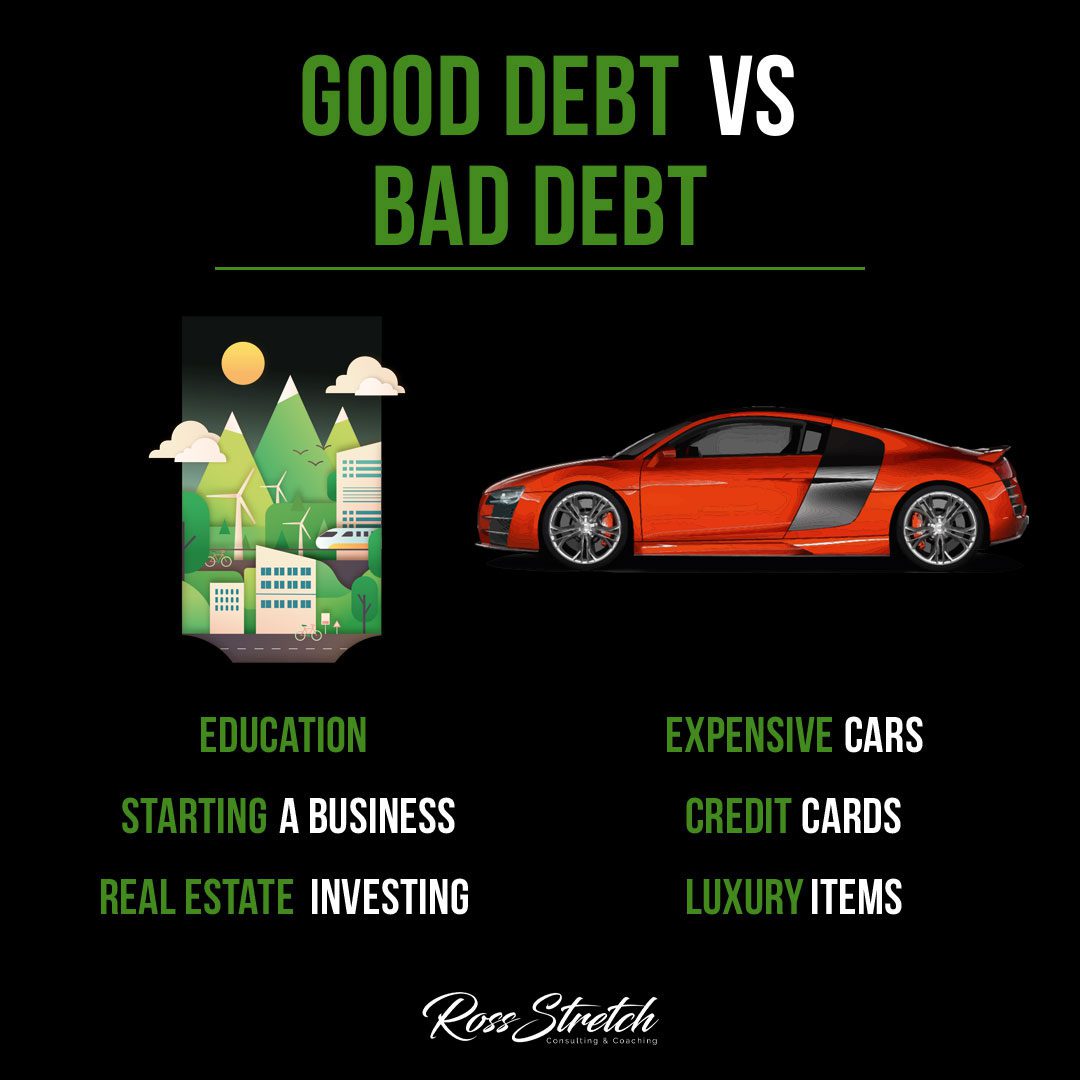

Debt is a part of life for many people. But not all debt is the same. Some types of debt can help you build wealth, while others can lead to financial stress. This guide explains the difference between good debt and bad debt, helping you make better choices about borrowing.

What is Good Debt?

Good debt is money borrowed to invest in things that grow in value or generate income. It’s often seen as a tool for wealth building. When used wisely, good debt can help you achieve your financial goals.

Examples of good debt include:

- Education: Investing in education can increase your earning potential. A degree or certification can lead to higher-paying jobs, making it easier to repay the debt.

- Starting a Business: Business loans can help entrepreneurs launch or expand a business. A successful business can generate income, making the loan worthwhile.

- Real Estate Investing: Taking a mortgage to buy property can be good debt. Real estate often increases in value over time, and rental income can help pay off the mortgage.

Why It’s Good: Good debt has the potential to bring a return on investment. It’s used to buy assets that can grow in value or generate income, making it easier to repay.

What is Bad Debt?

Bad debt is borrowing money for things that lose value or don’t provide financial returns. This type of debt can strain your finances and may take a long time to repay.

Examples of bad debt include:

- Expensive Cars: Cars lose value quickly, often by 20-30% in the first year alone. Taking out a big loan for a luxury car can leave you with debt on something that’s worth less over time.

- Credit Cards: Credit card debt can grow fast due to high-interest rates. Buying everyday items on credit can become expensive if you can’t pay off the balance each month.

- Luxury Items: Borrowing to buy designer clothes, gadgets, or vacations adds debt for things that won’t increase in value.

Why It’s Bad: Bad debt doesn’t offer a return on investment. It’s often spent on items that lose value, which can lead to financial stress if not managed carefully.

Comparing Good Debt and Bad Debt

Here’s a simple comparison of good debt and bad debt to help you understand the difference:

| Aspect | Good Debt | Bad Debt |

|---|---|---|

| Purpose | Investment or growth | Personal enjoyment |

| Examples | Education, business, real estate | Expensive cars, credit cards |

| Value Over Time | Increases | Decreases |

| Return | Has potential for returns | No returns, just expense |

How to Use Debt Wisely

Debt can be a powerful tool, but it needs to be managed carefully. Here are some tips to help you make smart choices with debt:

- Borrow with a Purpose: Only take on debt if it helps you reach a financial goal, like starting a business or buying a home.

- Avoid High-Interest Debt: High-interest rates make it harder to repay debt. Credit card debt is an example where interest costs can grow quickly.

- Plan Repayments: Make a budget to ensure you can repay any debt you take on. This helps you avoid financial stress.

- Consider the Long-Term Impact: Ask yourself if the debt will bring benefits in the future. If it won’t, it might not be worth it.

Conclusion

Understanding the difference between good debt and bad debt can help you make smart financial decisions. Good debt is an investment that can lead to greater wealth, while bad debt can limit your financial freedom. By using debt wisely, you can work towards a brighter financial future.