Introduction

Escaping the rat race is a common aspiration for many individuals seeking financial freedom and a more fulfilling life. Breaking free from the cycle of working to pay bills requires strategic planning, discipline, and a shift in mindset. In this article, we will explore five key strategies to help you escape the rat race and create a life of financial independence.

Develop frugal habits, manage your expenses wisely, and prioritize saving over excessive spending.

Ross Stretch

Save 12 Months of Expenses: Build a Safety Net

Having a solid financial foundation is essential when aiming to escape the rat race. Start by saving at least 12 months’ worth of expenses as an emergency fund. This safety net provides a cushion in case of unexpected events, such as a job loss or medical emergency.

Building a Strong Financial Foundation

Evaluate your monthly expenses and set a goal to save an amount equivalent to 12 months’ worth. This fund will give you peace of mind and the freedom to pursue new opportunities without the fear of financial instability.

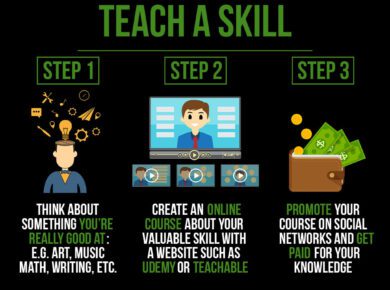

Create Streams of Revenue: Diversify Your Income

Relying solely on a single income source can keep you trapped in the rat race. To escape it, explore opportunities to create multiple streams of revenue. This can include starting a side business, investing in real estate, or generating passive income through investments.

Unlocking Financial Freedom Through Diversification

Identify your skills, passions, and interests to discover potential income streams. Consider launching a side business, exploring investment opportunities, or leveraging the power of the gig economy. Diversifying your income sources can provide financial stability and propel you toward escaping the rat race.

Have an End Goal: Define Your Financial Independence

To effectively escape the rat race, it’s important to have a clear vision of what financial independence means to you. Set specific end goals, such as achieving a certain level of passive income, retiring early, or starting a dream venture.

Defining Your Path to Financial Independence

Visualize your desired lifestyle and set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals to guide your actions. Establish milestones along the way and celebrate each achievement as you progress toward your ultimate goal of escaping the rat race.

Learn to Earn Passively: Embrace Passive Income Strategies

Passive income is a powerful tool in breaking free from the cycle of trading time for money. Explore opportunities to earn money while you sleep by investing in income-producing assets, such as stocks, rental properties, or online businesses.

Harnessing the Power of Passive Income

Educate yourself about different passive income strategies and identify those that align with your goals and interests. Seek guidance from experts, invest in financial education, and leverage technology to generate income passively. Embrace the potential of compounding returns and enjoy the freedom that passive income can provide.

Save Your Money: Cultivate Healthy Financial Habits

Lastly, saving money is a critical habit when striving to escape the rat race. Develop frugal habits, manage your expenses wisely, and prioritize saving over excessive spending.

Nurturing Financial Discipline and Freedom

Review your spending habits, identify areas where you can cut back, and make conscious choices about your expenses. Automate savings, create a budget, and track your progress regularly. Cultivating healthy financial habits will accelerate your journey toward financial independence.

Conclusion

Escaping the rat race requires deliberate action, commitment, and a mindset shift. By saving, creating multiple streams of revenue, setting end goals, pursuing passive income, and cultivating healthy financial habits, you can break free from the cycle of living paycheck to paycheck. Start today, take control of your financial future, and create a life of freedom and abundance.