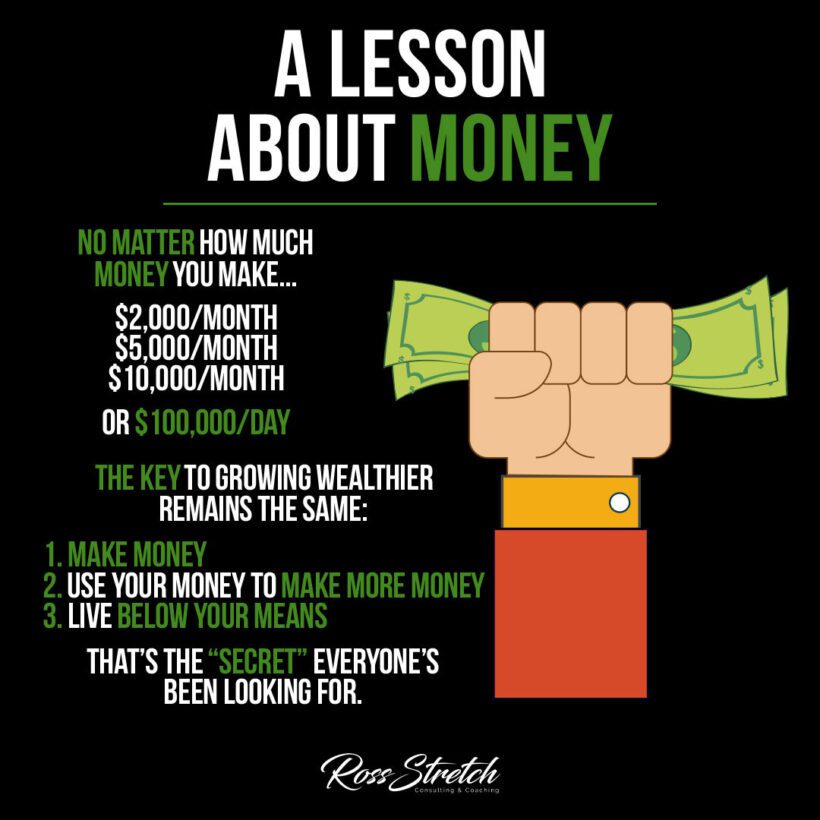

In the quest for financial security and wealth, certain principles are universal, transcending income brackets and economic conditions. The path to growing wealthier is often misconceived as complex or secretive, yet the truth lies in three fundamental practices: making money, using that money to make more money, and living below your means.

Making Money: The First Step to Wealth

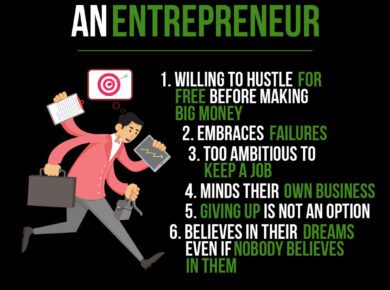

The foundation of wealth is income generation. Earning money through employment, entrepreneurship, or creative endeavors is the starting point.

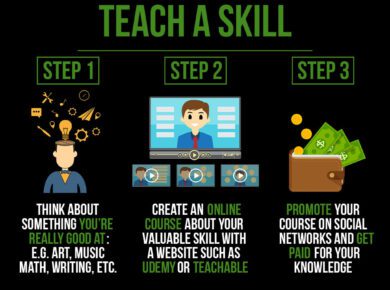

Strategies to Increase Earnings:

- Upskill to add value in your professional field.

- Seek additional income streams such as side hustles or freelance work.

- Invest in continuous learning to stay competitive.

Reinvesting: The Power of Compounding

Earning money is just the beginning. The next step is to use your earnings to generate additional income, often through investments.

Maximizing Reinvestment:

- Understand the basics of investing in stocks, real estate, or business ventures.

- Consider retirement accounts like 401(k)s or IRAs for tax advantages.

- Reinvest dividends and interest to benefit from compound growth.

Living Below Your Means: The Unsung Hero of Wealth Building

Living below your means is not about frugality; it’s about prioritizing financial freedom over immediate gratification.

Tips for Modest Living:

- Budget wisely to ensure expenses don’t exceed income.

- Avoid unnecessary debt that doesn’t contribute to wealth building.

- Save diligently and establish an emergency fund.

Balancing Income and Expenditure

The equilibrium between what you earn and what you spend is critical for financial growth. This balance is where your ability to save and invest is born.

Creating a Sustainable Financial Balance:

- Track your income and expenses meticulously.

- Identify areas where you can cut back without sacrificing quality of life.

- Set financial goals and review them regularly.

The Role of Financial Education

Knowledge is the cornerstone of wealth. Understanding financial concepts and market dynamics equips you with the tools to make informed decisions.

Building Financial Literacy:

- Read books and articles on personal finance.

- Attend workshops or seminars on wealth management.

- Consult with a financial advisor to tailor a plan to your circumstances.

Conclusion: Wealth Building Simplified

Building wealth doesn’t require a secret formula or a stroke of luck. It’s the result of disciplined earning, savvy reinvestment, and judicious spending. By adhering to these timeless principles, financial growth is not just possible; it’s inevitable.

Resources for Information:

The advice in this article is a synthesis of well-established financial wisdom, supported by:

- Personal Finance Books: Classic reads like “The Richest Man in Babylon” by George S. Clason offer timeless advice on saving and investing.

- Financial Planning Websites: Platforms like Investopedia provide extensive educational content on all aspects of finance and investment.

- Wealth Management Courses: Many universities and financial institutions offer courses on personal finance and wealth management.

By leveraging these resources, individuals can educate themselves on the foundational principles of wealth accumulation and apply these lessons to build a more secure financial future.