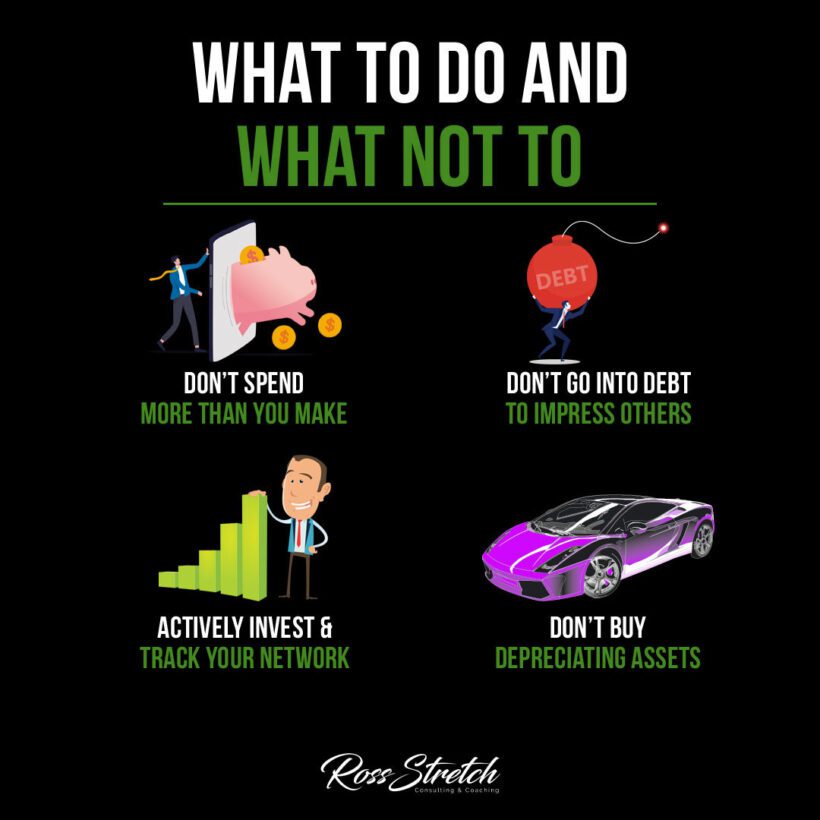

Navigating the world of personal finance can be daunting, but understanding the fundamental do’s and don’ts can set the stage for long-term financial health. Whether you’re just starting out or looking to refine your financial strategy, the following principles are crucial for maintaining a sound financial footing.

The Cardinal Rule: Spend Wisely

Living within your means is the bedrock of good financial health. It’s simple yet powerful advice: don’t spend more than you earn. This habit prevents unnecessary debt and builds the discipline required for wealth accumulation.

Crafting a Budget

Create a budget that tracks your income and expenses. Stick to it religiously, and adjust as needed to ensure you are always living within or below your means. Tools like budgeting apps can help keep you accountable.

The Lure of Impressions: Avoiding Debt

In a society that often values appearances, it’s easy to fall into the trap of spending to impress others. This can lead to a dangerous cycle of debt that undermines financial stability.

Financial Independence Over Impressions

Prioritize your financial independence over societal expectations. Make purchases based on need and value, not as a means to impress. Remember, true wealth is financial freedom, not expensive possessions.

Investing: The Path to Growth

Actively investing and tracking your net worth is crucial for financial growth. Investments can help your money grow at a higher rate than traditional savings, leading to increased wealth over time.

Diversifying Your Portfolio

Consider a diverse investment portfolio that includes stocks, bonds, real estate, or mutual funds. Use tools and resources to track your investments and net worth over time, adjusting your strategy to maximize growth.

The Depreciation Dilemma: Smart Asset Choices

Not all assets are created equal. Some, like certain luxury cars or electronics, depreciate quickly. Avoid pouring your money into assets that lose value over time.

Appreciating Assets

Focus on buying assets that are likely to appreciate or, at the very least, hold their value. This can include things like property, certain collectibles, or investments in education that can increase earning potential.

These foundational financial principles can help guide your spending and investment decisions. By living within your means, avoiding debt for superficial reasons, actively investing, and making smart asset choices, you can build a secure financial future.

For more detailed advice and strategies, consider consulting financial planning resources like “The Total Money Makeover” by Dave Ramsey or “Rich Dad Poor Dad” by Robert Kiyosaki, which offer in-depth guidance on managing personal finances. Additionally, online platforms like Investopedia provide a wealth of free financial education that can help you understand and navigate the complexities of investing and asset management. Remember, the journey to financial stability starts with informed decisions and disciplined habits.