Introduction:

In the world of personal finance, there’s an abundance of advice on how to manage your money. Yet, many find themselves trapped in a cycle of debt, uninformed investments, and quick-money schemes that promise wealth but deliver instability. Effective money management is not just about how much you earn but also about how you spend, save, and invest your earnings. This article unpacks the invaluable lessons of money management that are essential for a secure financial future.

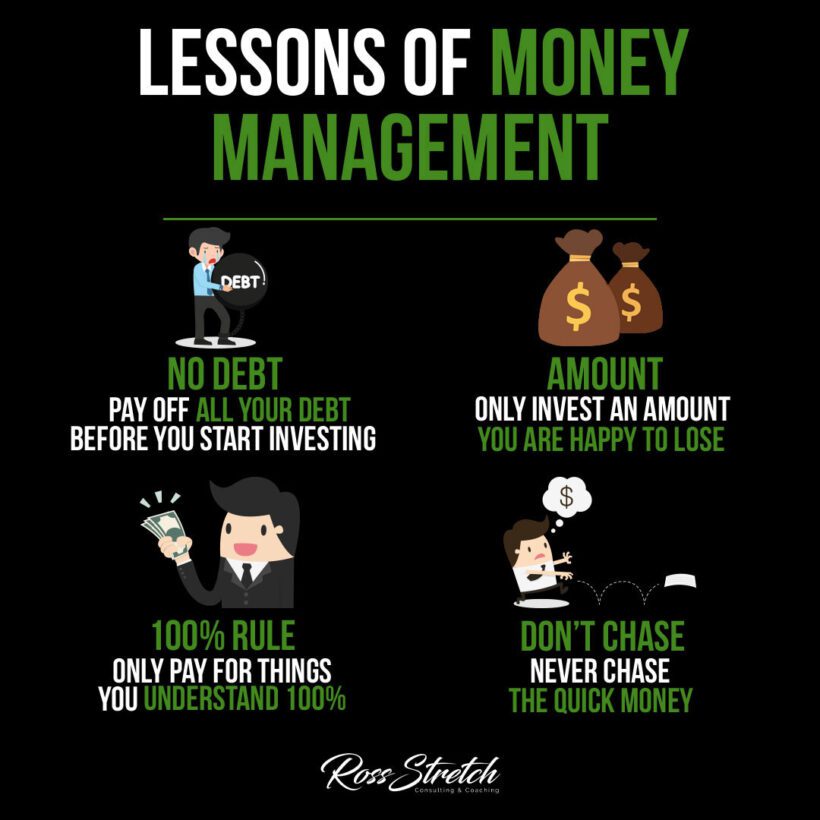

Eliminating Debt: The Path to Financial Freedom

Debt is often the greatest obstacle to achieving financial security. It’s a burden that can stifle your ability to grow wealth and limit your economic mobility. The no-debt principle is clear: pay off all your debt before you start investing. Why? Because the interest on debt can often exceed any potential returns from investments. By eliminating debt, you free up resources that can be redirected towards savings and investments, which can compound over time. This strategy also reduces financial stress, providing a clearer mindset for making future financial decisions.

Invest Wisely: The Art of Cautious Investment

The next cornerstone of money management is cautious investment. The rule is simple: only invest an amount you are happy to lose. It might sound pessimistic, but it’s a strategy that prepares you for the inherent risks of investing. This doesn’t mean you should expect to lose money, but rather, you should only invest surplus funds—money that, if lost, wouldn’t alter your lifestyle or financial stability. It’s about risk management and ensuring that a loss wouldn’t devastate your financial health.

The 100% Rule: Understanding Your Investments

Understanding what you’re investing in is crucial. The ‘100% Rule’ dictates that you should only pay for things you comprehend entirely. Before investing in stocks, bonds, real estate, or any other vehicle, take the time to study and understand the ins and outs. This means knowing the business models, the market trends, the risks, and the potential returns. Financial education is your best defense against poor investment decisions. When you fully understand your investments, you can make informed decisions that align with your financial goals and risk tolerance.

Avoiding the Pitfalls of Quick Money

In the pursuit of wealth, patience is a virtue. Chasing quick money is a gamble that can lead to significant losses. This article advises against speculative investments and get-rich-quick schemes that seem too good to be true—they usually are. True wealth is built over time through steady investments, consistent savings, and compound interest. The lure of quick money can be tempting, but the focus should be on building a strong financial foundation that will stand the test of time.

Creating a Money Management Plan

An effective money management plan involves a budget that tracks your income and expenses, sets aside savings, pays off debts, and makes thoughtful investments. It’s about understanding your financial situation and making strategic decisions that will lead to long-term prosperity. This plan should be revisited and adjusted as your financial situation evolves. It’s not set in stone; it’s a guide that helps you navigate your financial journey.

Incorporating Real-Life Success Stories

This article draws upon the experiences of those who have mastered the art of money management. From individuals who climbed out of crippling debt to those who have built impressive investment portfolios by following these principles, their stories serve as both instruction and inspiration.

Leveraging Tools for Money Management

To aid in your money management journey, several tools can be invaluable. Budgeting apps, investment tracking software, and educational resources can provide the support and knowledge necessary to make informed decisions. These tools can simplify the complexities of personal finance, making it more accessible for everyone to manage their money effectively.