Introduction:

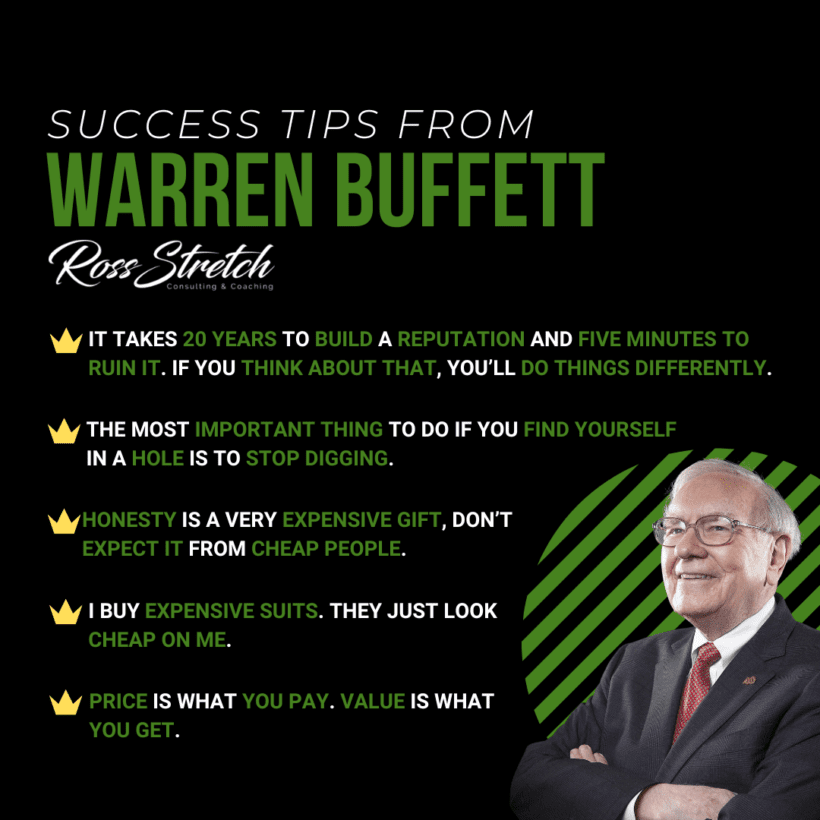

Warren Buffett, widely regarded as one of the most successful investors of all time, has amassed incredible wealth through his savvy investment decisions and astute business acumen. His philosophy, often referred to as the “Buffett Way,” emphasizes long-term value investing and rational decision-making. In this article, we will explore key success tips from Warren Buffett that can guide aspiring investors and individuals seeking financial success.

By following his principles of building a strong reputation, making wise financial decisions, and prioritizing honesty and integrity, individuals can navigate the complex world of finance with confidence and increase their chances of achieving long-term prosperity.

Ross Stretch

It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.

Warren Buffett understands the importance of a good reputation. He recognizes that building a reputation takes time and effort, but it can be easily tarnished by a single misstep. This mindset highlights the significance of maintaining integrity and making ethical decisions to preserve one’s reputation.

- Prioritize ethical behavior in all your dealings.

- Consistently deliver on your promises to build trust.

- Value long-term relationships over short-term gains.

- Act with integrity, even when faced with difficult choices.

The most important thing to do if you find yourself in a hole is to stop digging.

One of Warren Buffett’s key success tips is to avoid compounding mistakes by stopping the detrimental actions. Recognizing when a decision is leading to unfavorable outcomes and having the discipline to change course is crucial for financial success.

Price is what you pay. Value is what you get.

Buffett’s focus on distinguishing between price and value emphasizes the importance of evaluating investments based on their intrinsic worth rather than their current market price. This approach guides investors to seek out undervalued assets with growth potential.

- Conduct thorough research before making investment decisions.

- Focus on the intrinsic value of an asset rather than short-term fluctuations.

- Consider long-term growth prospects and competitive advantages.

- Practice discipline and avoid impulsive buying or selling.

Honesty is a very expensive gift, don’t expect it from cheap people.

Warren Buffett values honesty and integrity in all aspects of business and life. He understands that associating with individuals who lack integrity can lead to negative consequences. Surrounding yourself with honest and trustworthy people contributes to your own success.

I buy expensive suits. They just look cheap on me.

Buffett’s lighthearted remark about expensive suits reflects his frugality and down-to-earth nature. Despite his vast wealth, he maintains a humble approach to personal spending and emphasizes the importance of distinguishing between price and value.

- Foster a culture of honesty and transparency in your personal and professional life.

- Build relationships with individuals who share similar values and ethics.

- Focus on substance over appearances.

- Practice financial discipline and avoid unnecessary extravagance.

Conclusion:

Warren Buffett’s success tips offer invaluable insights into achieving wealth and financial success. By following his principles of building a strong reputation, making wise financial decisions, and prioritizing honesty and integrity, individuals can navigate the complex world of finance with confidence and increase their chances of achieving long-term prosperity. Let Warren Buffett’s wisdom guide you on your journey to financial success.

Resources:

- Berkshire Hathaway’s website: https://www.berkshirehathaway.com/

- Warren Buffett’s annual letters to shareholders: Available on Berkshire Hathaway’s website.

- “The Essays of Warren Buffett: Lessons for Corporate America” by Warren E. Buffett and Lawrence A. Cunningham.

- “The Intelligent Investor” by Benjamin Graham.

- CNBC’s coverage on Warren Buffett: https://www.cnbc.com/warren-buffett/

- Forbes’ articles on Warren Buffett: https://www.forbes.com/warren-buffett/

- Bloomberg’s coverage on Warren Buffett: https://www.bloomberg.com/warren-buffett/