Introduction

Warren Buffett, the Oracle of Omaha, is renowned for his simple yet profoundly effective investment strategy. His approach is not about quick wins; it’s about fundamental value and long-term growth. This strategy has turned Buffett into one of the wealthiest individuals on the planet and can serve as a blueprint for anyone looking to invest wisely.

Focusing on Intrinsic Value

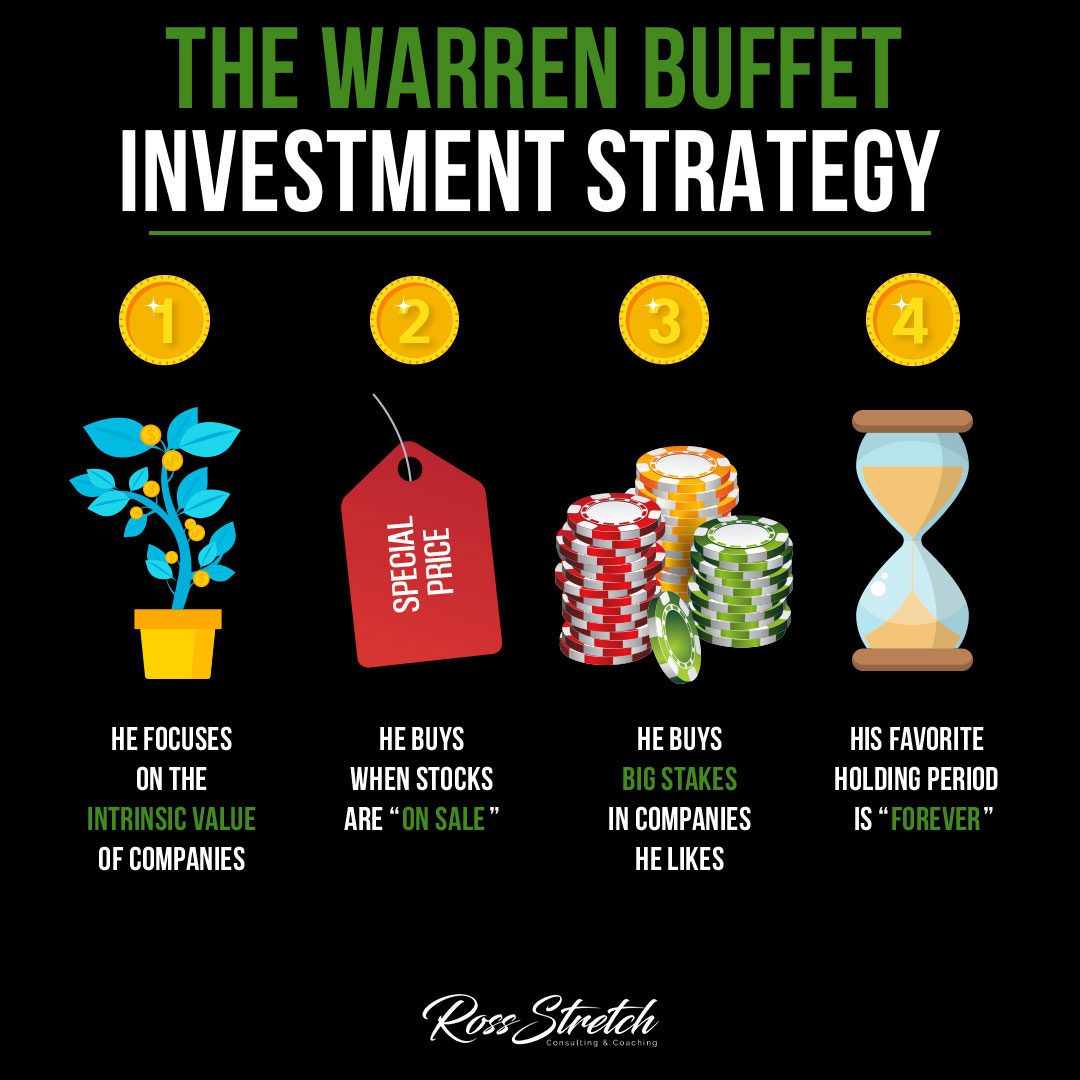

Buffett’s strategy begins with a focus on the intrinsic value of a company. He looks for businesses that have strong fundamentals, including a durable competitive advantage, sound management, and consistent earnings growth. This focus ensures investments are made in companies with a solid foundation that can withstand market fluctuations.

Buying When Stocks Are “On Sale”

Buffett’s approach to buying stocks “on sale” is akin to seeking out bargains. When the market is fearful and stock prices drop, Buffett sees opportunity. This strategy requires patience and the courage to go against the market’s tide, buying quality stocks at discounted prices.

Investing in Companies You Like

Buffett invests in businesses he understands and likes. This principle stems from the belief that having a personal affinity for a company’s products or services can be indicative of the business’s potential for long-term success. It’s not just about numbers; it’s about believing in the company’s mission and operations.

The “Forever” Holding Period

Buffett famously said, “Our favorite holding period is forever.” He eschews the short-term trading mentality, focusing instead on holding onto his investments indefinitely. This long-term perspective allows for the power of compounding to work its magic, as companies grow and reinvest their earnings over time.

The Psychology Behind Buffett’s Strategy

Buffett’s strategy isn’t just about the mechanics of investing; it’s also about the psychology. It requires a disciplined mind to stick to fundamental values, to remain patient when others are greedy, and to maintain a long-term perspective in a world obsessed with short-term results.

Buffett’s Strategy in Today’s Market

Applying Buffett’s principles in today’s fast-paced market may seem out of sync with the times, but the fundamental truths behind his strategy are timeless. Even as market dynamics change, the underlying principles of value investing remain as relevant as ever.

Conclusion

Warren Buffett’s investment strategy is a masterclass in discipline, patience, and foresight. By focusing on the intrinsic value of companies, buying stocks when they are undervalued, investing in companies that resonate personally, and holding for the long term, investors can aspire to achieve not just wealth, but investment wisdom.