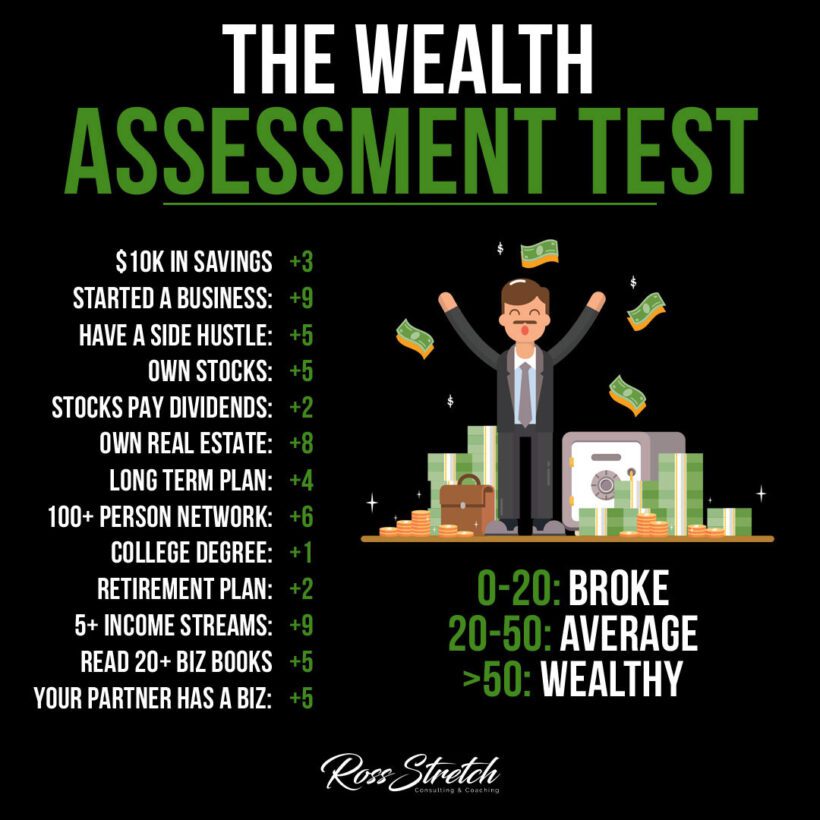

In the quest for financial stability and wealth, it’s crucial to have a clear understanding of where you stand and what actions can propel you forward. The journey from financial uncertainty to wealth is often marked by strategic decisions and disciplined habits. Here’s how you can assess your financial health and adopt wealth-building strategies that work.

Understanding Your Financial Position

Your financial health is more than just your current bank balance. It’s a composite of savings, investments, assets, and strategic planning for the future.

The Savings Baseline

A healthy savings account is a cornerstone of financial security. Experts often recommend having at least $10,000 in savings as a buffer against unexpected expenses.

The Enterprising Spirit: Starting a Business

Entrepreneurship is a potent engine for wealth creation. Starting a business can significantly boost your financial prospects, but it requires courage, innovation, and persistence.

Capitalizing on Business Ventures

Venturing into business isn’t just about the potential financial reward—it’s also about building a legacy and harnessing your passion into a profitable venture.

Diversifying Income: The Side Hustle Era

Having multiple streams of income, such as a side hustle, is becoming increasingly important in the modern economy. It’s about resilience and having alternative sources of income if one stream falters.

Cultivating Multiple Revenue Streams

Whether it’s freelancing, investing in stocks, or starting a small online business, diversified income streams can lead to a more robust financial profile.

Investment Savvy: Stocks and Real Estate

Investing in stocks, especially those that pay dividends, and owning real estate are time-tested pathways to wealth accumulation.

Navigating the Investment Landscape

Educate yourself on investment strategies, understand market trends, and consider seeking advice from financial advisors to build a portfolio that reflects your financial goals and risk tolerance.

The Power of Networking

Building a network of over 100 people can open doors to opportunities in various industries. It’s not just about the quantity of connections but the quality of relationships you foster.

Leveraging Relationships

Networking is a skill that can be honed through attending industry events, joining professional organizations, and engaging on professional social platforms like LinkedIn.

Education and Continuous Learning

A college degree can be a stepping stone to higher earning potential. However, self-education, particularly in business and financial literacy, is just as vital.

The Importance of Self-Education

Reading business books, attending workshops, and continuous learning can provide you with the knowledge to make informed financial decisions.

Planning for the Future

Having a retirement plan and a long-term financial strategy is indicative of a forward-thinking approach to wealth.

Securing Your Financial Future

Look into retirement accounts, estate planning, and insurance to protect and grow your wealth for the years to come.

Partnership in Prosperity

If your partner is also engaged in a business, it can double the avenues for financial growth and provide additional support in wealth-building endeavors.

The Duo Dynamic

Discuss and align financial goals with your partner to ensure you’re both contributing to a shared vision of prosperity.

Building wealth is a deliberate process that requires a mix of financial acumen, strategic planning, and personal growth. By assessing where you stand and adopting the practices that lead to wealth, you can transform your financial trajectory.

For more in-depth guidance, consider resources like “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko, which explores the habits of the wealthy, or “Your Money or Your Life” by Vicki Robin and Joe Dominguez, offering a blueprint for managing your finances and achieving financial independence. Remember, wealth is not just about the money—it’s about the freedom and choices that money can provide.