Introduction

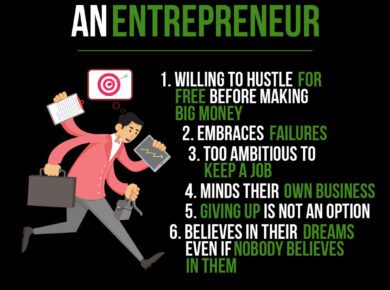

Navigating the world of trading requires a fine balance between strategic knowledge and psychological fortitude. It’s not just about analyzing charts and numbers; it’s about developing a disciplined approach to manage risks, control emotions, and execute well-crafted strategies. In this comprehensive guide, we will explore the basic yet pivotal principles that lay the groundwork for becoming a successful trader. From the rookie enthusiast to the seasoned professional, understanding these principles is crucial for anyone looking to succeed in the high-stakes world of trading.

Learn to Manage Risks

Risk management is the cornerstone of any successful trading endeavor. The ability to manage risks effectively differentiates the novices from the veterans in the trading arena. It involves more than just recognizing potential pitfalls; it encompasses a series of disciplined practices and decision-making processes that protect a trader’s capital against market adversities.

A sound risk management strategy begins with the trader’s acknowledgement that not all trades will be successful. By accepting losses as a natural part of the trading process, traders can focus on minimizing losses and maximizing gains. Key techniques in risk management include setting stop-loss orders, which serve as a safety net to automatically exit a position at a predetermined price, thereby limiting potential losses. Additionally, traders should employ risk-to-reward ratios to assess the viability of a trade. A common approach is to aim for a ratio where the potential reward is at least twice the potential risk.

Another crucial aspect of risk management is position sizing, which ensures that a trader does not overexpose their portfolio to a single trade. The golden rule here is not to risk more than a small percentage of the total capital on a single trade, thus avoiding significant setbacks from unexpected market moves.

Learn to Control Emotions and Resist Greed

The psychological aspect of trading is often underestimated, yet it is just as important as the technical skills. Emotions like fear and greed can cloud judgment, leading to impulsive decisions that deviate from a well-thought-out trading plan. Learning to control these emotions is a vital skill for any trader aiming for long-term success.

Fear can manifest in several ways: fear of missing out (FOMO) can cause traders to enter trades without proper analysis, while fear of losses might lead them to exit profitable trades too early. Conversely, greed can lead to overtrading or holding onto positions for too long in the hope of higher profits, often resulting in significant losses.

Developing emotional discipline involves adhering to a trading plan and resisting the urge to make trades based on emotional responses. Traders should set clear entry and exit criteria and follow them meticulously, regardless of the emotional pulls that may arise during trading sessions.

Write Plans and Strategies

Behind every successful trader is a well-crafted trading plan. This plan outlines the trader’s financial goals, risk tolerance levels, analysis methods, and criteria for entering and exiting trades. It acts as a blueprint that guides all trading activities, helping traders to remain focused and systematic in their approach.

A comprehensive trading strategy also takes into account market conditions and adapts to them. It includes a mix of technical analysis, fundamental analysis, and perhaps elements of quantitative analysis. Having a robust strategy allows traders to navigate through different market phases—whether it’s a bull or bear market, a period of high volatility, or a sideways-moving market.

In conclusion, the fundamentals of successful trading are rooted in risk management, emotional control, and strategic planning. By mastering these basics, traders can build a solid foundation for their trading career and increase their chances of achieving sustainable profitability in the financial markets.