Introduction

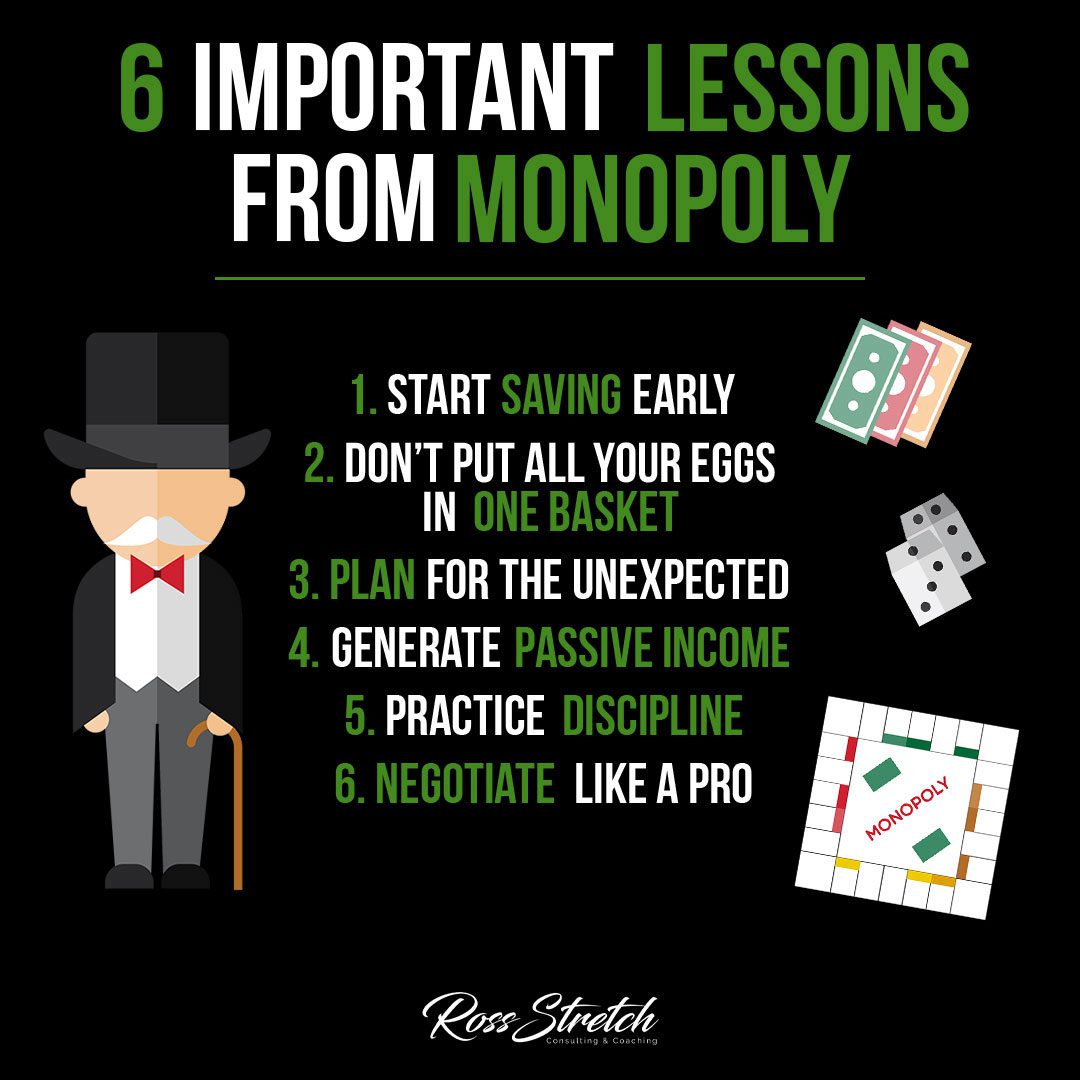

Monopoly, the iconic board game loved by millions, not only offers hours of fun and entertainment but also provides valuable lessons in financial management and strategy. As you navigate the game’s virtual world of property ownership and money management, you can uncover important insights that translate into real-life financial success. In this article, we will explore six significant lessons derived from playing Monopoly that can help you make wise decisions and achieve your financial goals.

One of the key strategies in Monopoly is acquiring properties and collecting rent from other players. This concept translates into the real world through the generation of passive income. Passive income refers to money earned with minimal effort or time investment, such as rental properties, dividends from stocks, or royalties from intellectual property

Ross Stretch

Start Saving Early

One of the fundamental lessons Monopoly teaches us is the importance of saving early. In the game, players quickly realize the advantage of accumulating cash reserves to invest in properties and withstand unforeseen expenses. This lesson applies to real life as well. By starting to save early and consistently setting aside a portion of your income, you can build a solid financial foundation. Saving early allows your money to grow through compounding, giving you a head start in achieving your long-term financial objectives.

Don’t Put All Your Eggs in One Basket

In Monopoly, diversification is key to success. Focusing solely on a single property or color group can leave you vulnerable to opponents’ strategies and unexpected events like landing on opponents’ monopolies. The same principle applies to real-life investments. Diversifying your portfolio across different asset classes, such as stocks, bonds, and real estate, helps mitigate risk and increase the potential for long-term growth. By spreading your investments, you can protect yourself from significant losses and maximize your chances of financial success.

Plan for the Unexpected

Monopoly is full of unexpected events, such as landing on expensive properties or drawing Chance or Community Chest cards that require immediate payments. These surprises emphasize the importance of having an emergency fund and planning for the unexpected in real life. Building a financial safety net can help you weather unforeseen expenses, job loss, or medical emergencies without derailing your long-term financial goals. Aim to save at least three to six months’ worth of living expenses in an easily accessible account.

Generate Passive Income

One of the key strategies in Monopoly is acquiring properties and collecting rent from other players. This concept translates into the real world through the generation of passive income. Passive income refers to money earned with minimal effort or time investment, such as rental properties, dividends from stocks, or royalties from intellectual property. By focusing on creating passive income streams, you can increase your financial stability and create opportunities for wealth accumulation.

Practice Discipline

Monopoly requires strategic decision-making, including when to buy or sell properties, when to build houses or hotels, and when to negotiate deals. These choices highlight the importance of discipline in managing your finances. Practicing discipline means making informed decisions, sticking to a budget, avoiding impulsive purchases, and staying committed to your long-term financial goals. By exercising discipline in your financial habits, you set yourself up for sustainable financial success.

Negotiate Like a Pro

Negotiation skills play a significant role in Monopoly, where players constantly engage in deals to buy, sell, or trade properties. Similarly, effective negotiation skills can benefit you in real-life financial transactions. Whether you’re negotiating a salary, purchasing a property, or securing a favorable interest rate, the ability to advocate for yourself and find mutually beneficial agreements can make a substantial difference in your financial outcomes. Sharpening your negotiation skills can lead to significant savings and increased financial gains.

Conclusion

Playing Monopoly offers more than just entertainment—it imparts valuable lessons that can help shape your financial mindset and strategies. By applying the six important lessons from Monopoly—starting saving early, diversifying investments, planning for the unexpected, generating passive income, practicing discipline, and negotiating like a pro—you can enhance your financial decision-making and set yourself on a path to long-term financial success. So, take these lessons to heart, both in the game and in your financial journey, and watch your wealth grow.