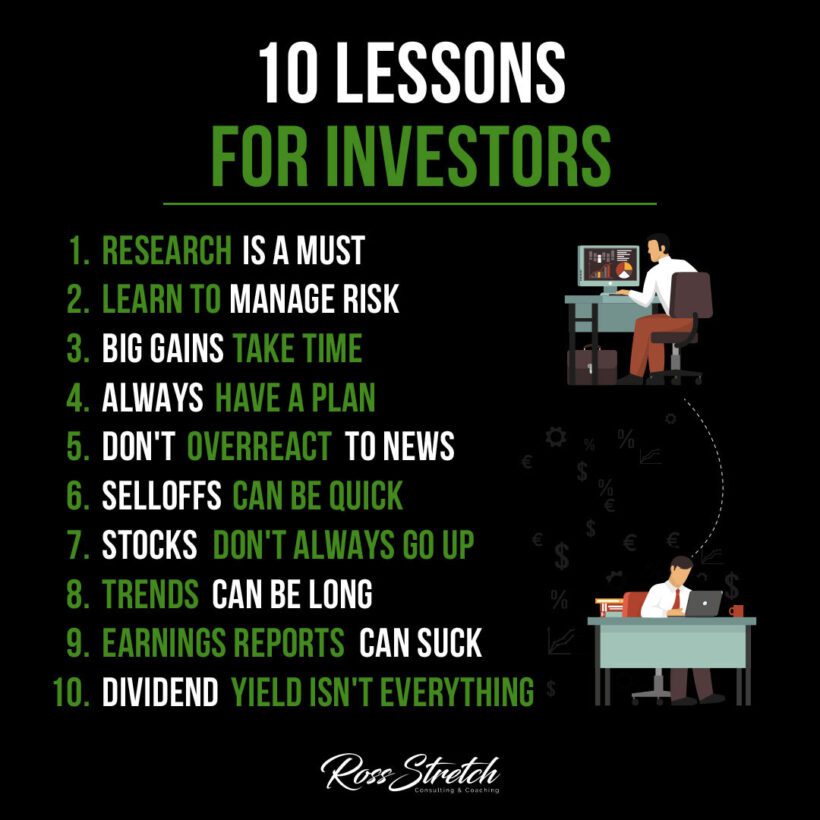

Investing is a journey that demands not just capital but also a deep understanding of the market’s ebbs and flows. It requires a disciplined approach and a clear-eyed recognition of the inherent risks and rewards. Below are ten lessons that every investor should take to heart, whether a novice or seasoned in the market.

1. Research: The Cornerstone of Investing

The importance of research cannot be overstated. It is the due diligence that separates informed decisions from costly mistakes.

Prioritizing Research in Your Investment Routine

- Utilize financial news, market analyses, and expert commentary.

- Study historical performance and industry trends.

- Regularly review and update your knowledge base as markets evolve.

2. Risk Management: The Art of Balancing

Learning to manage risk is critical to preserving and growing your investment. It’s about knowing how much exposure is acceptable and how to mitigate potential losses.

Strategies for Effective Risk Management

- Diversify your investment portfolio.

- Set stop-loss orders to limit potential losses.

- Continuously assess the risk-reward ratio of your investments.

3. Patience in Pursuit of Gains

Big gains often require time. The market rewards the patient and punishes the hasty.

Cultivating Patience as an Investor

- Resist the urge for quick wins in favor of long-term strategies.

- Recognize that market cycles can play a significant role in investment outcomes.

- Practice steady, consistent investing instead of trying to time the market.

4. Planning: Your Investment Blueprint

A well-thought-out plan is essential. It keeps you focused and can help avoid emotional decision-making.

Developing a Robust Investment Plan

- Define clear financial goals and investment criteria.

- Prepare for different market scenarios.

- Review and adjust your plan as needed to stay on course.

5. News: A Double-Edged Sword

Don’t overreact to news. The market is often driven by sentiment in the short term, which can lead to volatility.

Navigating Market News

- Discern between news that affects market fundamentals and mere noise.

- Avoid making impulsive decisions based on sensational headlines.

- Stay true to your investment plan unless fundamentals change significantly.

6. Understanding Market Selloffs

Selloffs can occur swiftly and can be driven by various factors. Recognizing the signs can help you respond appropriately.

Managing During Selloffs

- Maintain a long-term perspective.

- Look for opportunities to buy quality assets at lower prices.

- Ensure you have a cash reserve for such events.

7. The Reality of Stock Fluctuations

Stocks don’t always go up. Markets can be cyclical, and downturns are a natural part of investing.

Dealing with Stock Volatility

- Accept volatility as a normal aspect of investing.

- Avoid panic selling during downturns.

- Focus on companies with solid fundamentals.

8. Trends: Long-Term Investment Friends

Trends can be powerful and long-lasting. Identifying and investing in trends requires insight and foresight.

Investing in Market Trends

- Research to identify sustainable trends.

- Use trends to guide but not dictate your investment choices.

- Be wary of jumping on trends too late.

9. Earnings Reports: Not Always Rosy

Earnings reports can be disappointing, but they offer valuable insights into a company’s health.

Interpreting Earnings Reports

- Look beyond the headlines to understand the reasons behind the numbers.

- Use earnings reports as one of several tools to assess investment viability.

10. Dividend Yield: Not the Sole Factor

While a high dividend yield can be attractive, it isn’t the only metric to consider when investing.

Evaluating Dividend Stocks

- Consider the company’s dividend history and the sustainability of its payout ratio.

- Assess the overall health of the business and its growth prospects.

Conclusion: Building a Successful Investment Portfolio

Investing successfully requires adherence to fundamental principles. By integrating these ten lessons into your investment strategy, you can build a portfolio that is robust, resilient, and poised for growth over the long term.