The journey to financial freedom is often a tale of two paths: entrepreneurship and traditional employment. Common perceptions about these paths can shape our approach to work and wealth, sometimes to our detriment. This article explores the paradoxical views on time investment in business versus a job and how this affects our financial trajectory.

The Entrepreneurial Race Against Time

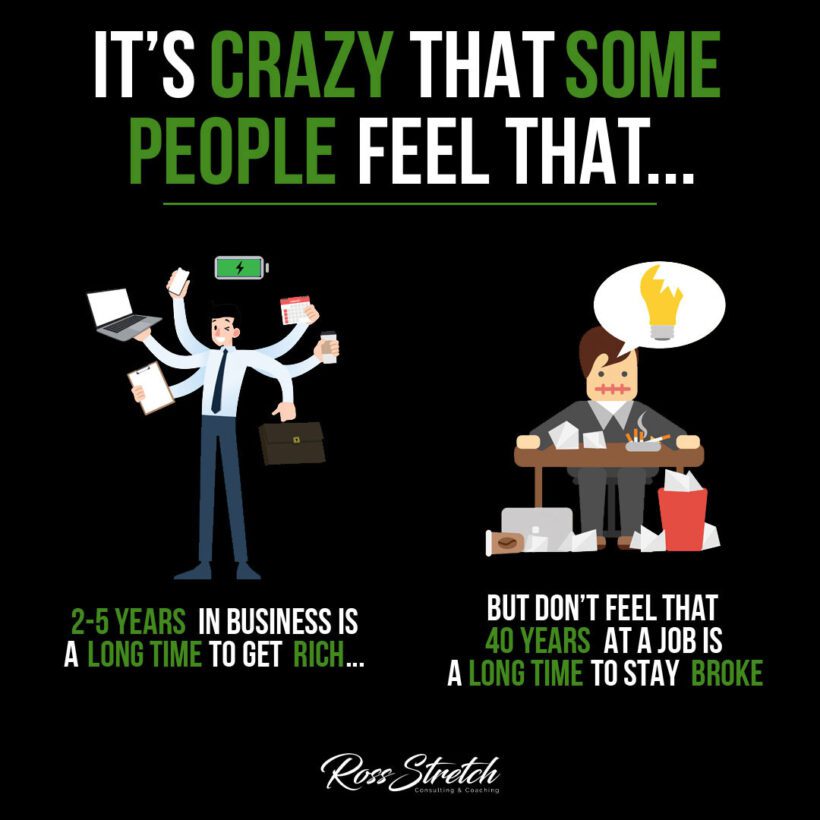

The entrepreneurial path is often viewed as a high-speed chase to riches, with a common belief that 2-5 years in business should be enough to attain wealth. However, this sprint mindset overlooks the marathon effort required to build a sustainable and profitable business.

Building Sustainable Businesses

The reality is that building a sustainable business takes time, perseverance, and resilience. Success stories are often the result of unseen years of hard work, strategic planning, and continuous learning. The key is to set realistic expectations and commit to the long-term journey of growth.

The Employment Longevity Paradox

Conversely, many individuals accept the norm of working a traditional job for 40 years without achieving financial freedom. This acceptance often comes from a belief in the security and predictability that employment provides.

Challenging Traditional Employment Beliefs

It’s crucial to challenge the notion that long-term employment guarantees financial stability. Employees should be encouraged to seek opportunities for advancement, invest in continuous education, and understand the power of saving and investing to break the cycle of living paycheck to paycheck.

Time Perception and Financial Outcomes

How we perceive the time dedicated to our work can profoundly influence our financial outcomes. Whether you’re an entrepreneur or an employee, valuing your time and using it wisely is paramount.

Valuing Time as an Asset

Time is a finite asset, and its allocation can determine wealth accumulation. Both entrepreneurs and employees must evaluate how they spend their time and make strategic decisions to ensure that their time investment aligns with their financial goals.

The Wealth Building Mindset

Developing a wealth-building mindset involves more than just working hard; it includes making informed decisions about where to focus your energy for the highest return on investment.

Strategies for Maximizing Time Investment

Employ strategies like goal setting, prioritization, and efficiency to maximize your time investment. Entrepreneurs should focus on activities that scale their business, while employees should seek roles that offer growth and learning opportunities.

Financial Education: The Great Equalizer

Financial literacy is often the missing link between work and wealth. Regardless of your career path, understanding the principles of personal finance is crucial.

Accessing Financial Education Resources

Take advantage of resources such as financial literacy workshops, online courses, and books on personal finance. Knowledge in areas like investing, budgeting, and financial planning empowers both entrepreneurs and employees to make smarter financial decisions.

In conclusion, the journey to wealth is not a simple race against time but a complex process that requires a strategic approach to time management and financial education. Whether you choose the path of entrepreneurship or traditional employment, the key is to leverage time wisely and continuously seek knowledge to build financial security and independence.

For more in-depth information, consider reading “Rich Dad Poor Dad” by Robert Kiyosaki for insights on financial independence and “The Lean Startup” by Eric Ries for principles of building a successful business. Additionally, the Financial Independence, Retire Early (FIRE) movement provides a wealth of information on the principles of saving and investing to achieve financial freedom.