Introduction:

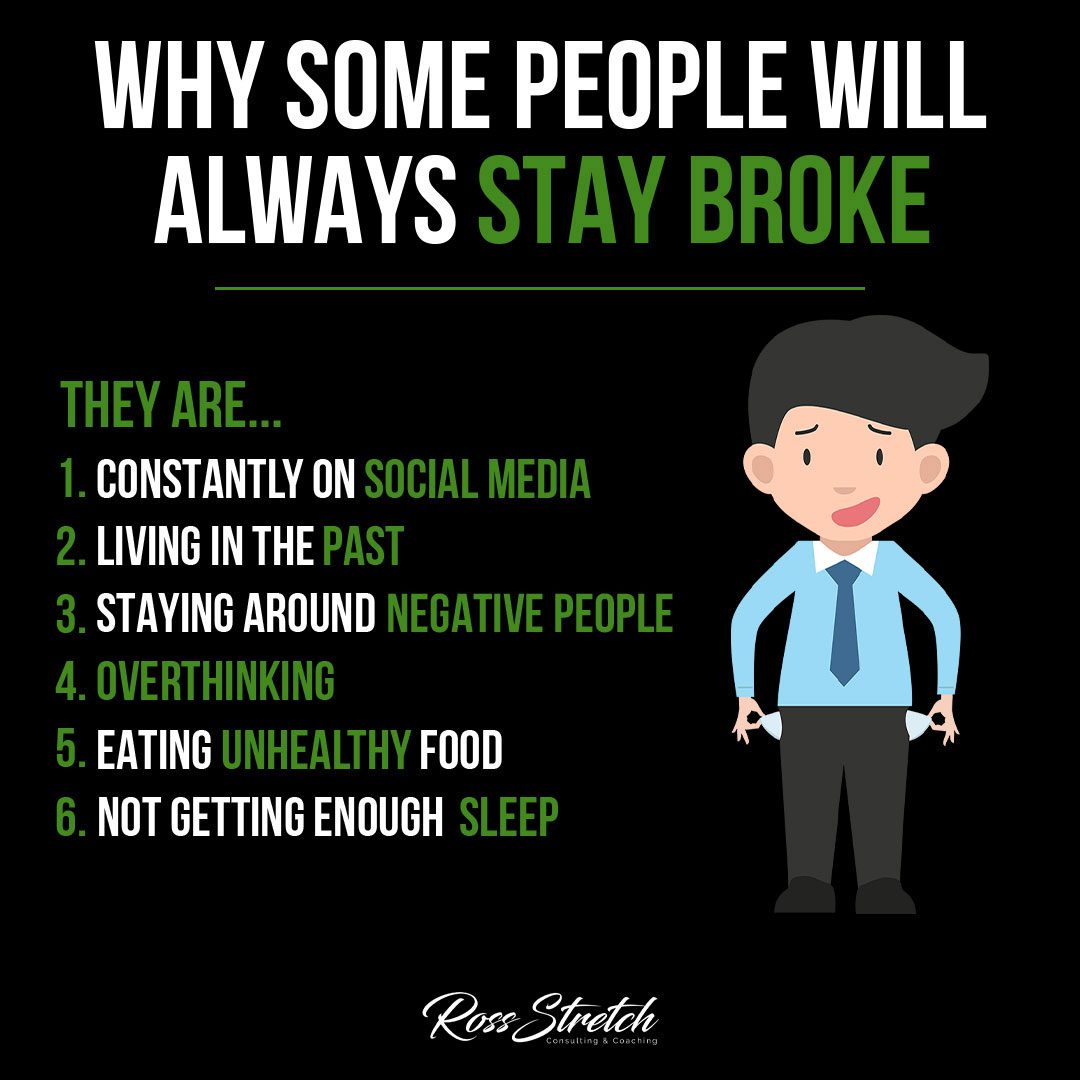

Financial stability is a goal that many people strive for, but for some, it seems perpetually out of reach. Understanding the reasons why some individuals stay broke can shed light on common patterns that hinder financial progress. In this article, we delve into various factors that contribute to financial challenges and offer insights on how to overcome them.

By recognizing the impact of social media, dwelling in the past, negative influences, overthinking, unhealthy habits, and lack of sleep, individuals can take steps towards achieving financial stability and building a brighter future.

Ross Stretch

Constantly on Social Media:

The influence of social media on financial well-being cannot be overlooked. Consider the following points:

- The comparison trap: Social media often presents an idealized version of others’ lives, leading to feelings of inadequacy and a desire for material possessions.

- Impulsive spending: Exposure to targeted ads and online shopping platforms can tempt individuals into impulsive purchases, leading to financial strain.

- Living in the Past: Dwelling on past financial mistakes or missed opportunities can impede future financial growth. Consider the following aspects:

Living in the Past:

Dwelling on past financial mistakes or missed opportunities can impede future financial growth. Consider the following aspects:

- Regret and guilt: Dwelling on past financial decisions can create negative emotions, making it difficult to move forward and make positive changes.

- Learning from mistakes: Instead of fixating on past missteps, it is crucial to learn from them and apply those lessons to future financial decisions.

Staying Around Negative People:

The people we surround ourselves with can have a significant impact on our financial mindset. Consider the following factors:

- Financial attitudes and habits: Negative influences who exhibit poor financial habits can discourage positive financial behaviors and perpetuate a cycle of financial struggle.

- Surrounding yourself with positive influences: Seek out individuals who demonstrate financial responsibility and share similar goals, as their influence can inspire positive financial changes.

Overthinking:

Overthinking can hinder financial progress by creating paralysis or preventing individuals from taking calculated risks. Consider the following points:

- Analysis paralysis: Excessive analysis and indecisiveness can result in missed opportunities for financial growth and wealth accumulation.

- Taking calculated risks: While financial decisions should be thoughtful, it is essential to recognize when action is necessary and take calculated risks to achieve financial goals.

Eating Unhealthy Food:

The relationship between physical and financial health is often overlooked. Consider the following aspects:

- Impacts on overall well-being: Poor nutrition and unhealthy eating habits can lead to decreased productivity, increased healthcare expenses, and reduced financial stability.

- Prioritizing health: By adopting a balanced and nutritious diet, individuals can improve their physical and mental well-being, leading to increased productivity and financial resilience.

Not Getting Enough Sleep:

Sleep deprivation can have significant consequences on financial well-being. Consider the following factors:

- Impaired decision-making: Lack of sleep can impair judgment and lead to impulsive financial decisions with long-term negative consequences.

- Prioritizing rest: Establishing healthy sleep habits can enhance cognitive function, decision-making abilities, and overall financial well-being.

Conclusion:

Breaking free from the patterns that contribute to financial struggle is possible with awareness, intention, and action. By recognizing the impact of social media, dwelling in the past, negative influences, overthinking, unhealthy habits, and lack of sleep, individuals can take steps towards achieving financial stability and building a brighter future.

References:

- Akram, U., & Kumar, R. (2020). Social Media and Its Impact on Financial Behavior: A Systematic Literature Review. International Journal of Information Management, 50, 227-241.

- Muehling, D. D., & Harari, M. B. (2018). From Frugal Feasting to Fast Food: The Impact of Food Consumption on Financial Stability. Journal of Consumer Affairs, 52(3), 758-783.

- Gombodorj, M., & Ishimura, Y. (2020). Impact of Sleep Deprivation on Decision-Making: A Review. Journal of Advanced Research in Dynamical and Control Systems, 12(2), 144-156.