Achieving financial freedom is a goal for many, and passive income is a powerful tool to make it possible. Passive income generates earnings without continuous active effort, allowing you to free up your time, focus on your passions, and achieve financial independence. Here’s a guide to understanding the benefits of passive income, exploring different passive income sources, and taking steps toward financial freedom.

1. Understanding Passive Income and Why It Leads to Freedom

Passive income refers to money earned with little to no active involvement once the initial setup is complete. This income type differs from active income, which requires continuous work, like a traditional job or freelance project. Passive income can come from investments, rental properties, digital products, and more.

- How Passive Income Leads to Freedom:

- Time Flexibility: Passive income allows you to earn money without trading hours for dollars, freeing up time for personal pursuits.

- Financial Security: With steady passive income, you can reduce financial stress and rely less on paycheck-to-paycheck living.

- Location Independence: Many passive income streams are digital, allowing you to work from anywhere, including while traveling or from home.

With passive income, you can enjoy financial stability and freedom to pursue life on your terms, spending time on activities that truly matter.

2. Popular Sources of Passive Income

There are multiple ways to establish passive income, and each has unique advantages depending on your interests, skills, and financial situation. Here are some popular options to consider:

- Real Estate Investment:

- Rental Properties: Purchasing rental properties allows you to generate monthly rental income. While property management requires some initial setup, income becomes relatively passive over time.

- Real Estate Investment Trusts (REITs): If managing a property isn’t appealing, REITs allow you to invest in real estate portfolios and earn dividends without direct ownership.

- Pros: Steady cash flow, property appreciation.

- Cons: Initial capital required, property maintenance responsibilities.

- Dividend Stocks and Index Funds:

- Dividend Stocks: Investing in dividend-paying stocks provides periodic income through company profit shares.

- Index Funds and ETFs: These funds offer diversified exposure to stock markets, reducing risk and paying dividends over time.

- Pros: Potential for capital appreciation and dividends.

- Cons: Market risk, requires initial investment and regular monitoring.

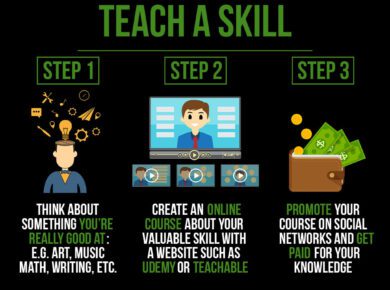

- Digital Products and Online Courses:

- E-books, Courses, and Printables: Creating digital products like e-books, online courses, and printables allows for recurring income without ongoing effort once the product is complete.

- Affiliate Marketing on Blogs or YouTube: Content creators earn commissions by recommending products or services through affiliate links.

- Pros: Minimal ongoing costs, scalable potential.

- Cons: Requires upfront time and effort to create content and build an audience.

Each of these income streams has the potential to generate consistent revenue, giving you more control over your finances and reducing dependence on traditional employment.

3. Steps to Build Your Passive Income Streams

Building passive income takes planning and persistence, but with the right strategy, you can establish streams that work for you over time. Here’s a step-by-step guide to get started:

- Identify Your Resources and Interests:

- Evaluate the time, capital, and skills you have available. If you have a significant savings pool, consider investing in real estate or dividend stocks. For those with creative skills, digital products or affiliate marketing might be more suitable.

- Research and Choose a Passive Income Stream:

- Choose an option that aligns with your goals and resources. Start with one income stream initially to focus your efforts, whether it’s writing an e-book, creating an online course, or investing in index funds.

- Set Up and Automate:

- For digital products, publish on platforms like Amazon Kindle, Udemy, or Etsy, which handle the sales and distribution process. For investments, set up automated contributions to dividend stocks or REITs to grow your income over time.

- Scale and Diversify:

- Once your first passive income stream is established, consider adding another to increase income potential and diversify risk. Scaling can include creating additional products, expanding your real estate portfolio, or diversifying your stock investments.

By following these steps, you can create reliable passive income streams that work toward financial independence.

4. The Benefits of Passive Income Beyond Finances

While financial security is a primary goal, passive income also brings a range of personal benefits that contribute to a fulfilling life.

- Personal Growth: With passive income covering basic expenses, you can explore new interests, pursue further education, or dedicate time to personal growth activities.

- Work-Life Balance: Financial freedom provides the ability to step back from a demanding career and achieve a better work-life balance.

- Increased Flexibility and Freedom: Without the constraints of a traditional job, you can make choices that align with your passions and values, such as spending more time with family or supporting causes that matter to you.

Beyond just money, passive income provides the freedom to design a lifestyle that aligns with your aspirations and values.

5. Common Misconceptions About Passive Income

Many people believe that passive income requires no work or that it’s a quick way to get rich. In reality, creating sustainable passive income streams often requires substantial initial effort and patience.

- Myth 1: Passive Income is Effortless

- While passive income doesn’t require constant effort, setting up a reliable stream involves upfront work and sometimes ongoing maintenance.

- Myth 2: Passive Income Will Make You Rich Quickly

- Building significant passive income takes time. The path to financial freedom is gradual and requires discipline, but it can yield substantial rewards over time.

- Myth 3: You Need a Lot of Money to Start

- Many passive income streams, like digital products or affiliate marketing, require little capital upfront, allowing anyone to get started with minimal risk.

Understanding the realities of passive income can help set realistic expectations, enabling you to stay committed and see long-term success.

Conclusion

Passive income is a powerful way to achieve financial independence, providing freedom to spend your time, money, and energy on your own terms. By exploring and establishing multiple passive income sources—whether through investments, real estate, or digital products—you can create a stable financial foundation that supports your goals. Remember, while passive income requires upfront effort, the benefits it brings in terms of freedom and flexibility make it a worthwhile investment in your future.