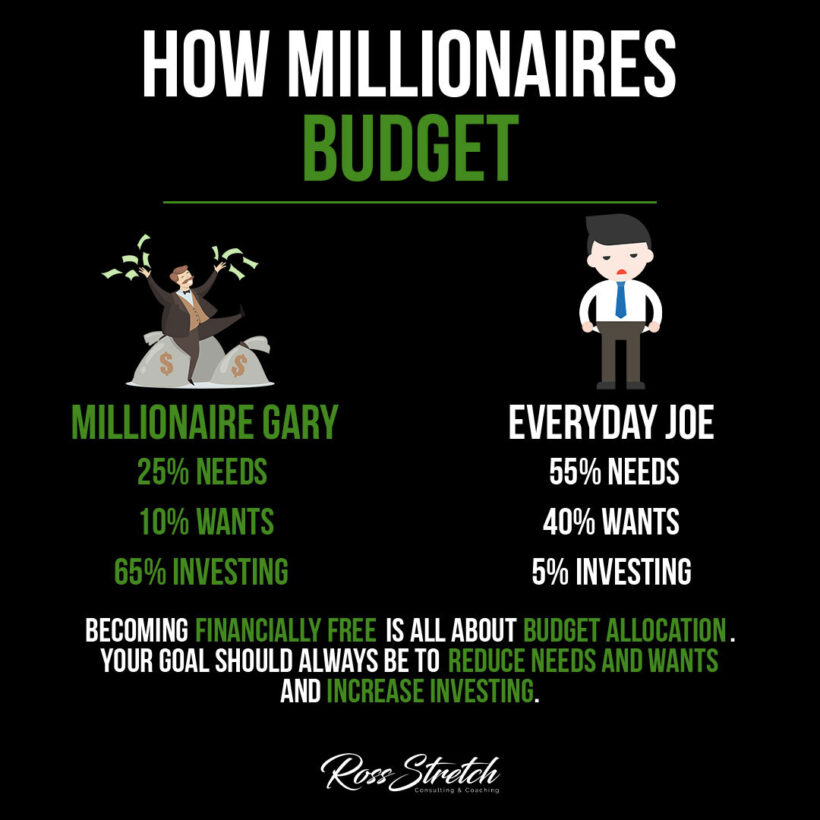

Budgeting is not just about covering expenses; it’s about paving the way to financial freedom. Millionaires approach budgeting differently than most people. They focus on needs, limit their wants, and maximize investments. Here’s a breakdown of how “Millionaire Gary” budgets his income compared to “Everyday Joe.”

Budget Breakdown

1. Millionaire Gary

- 25% Needs: Gary spends only 25% of his income on essential needs like housing, food, and transportation.

- 10% Wants: He keeps his discretionary spending low, using only 10% for things he enjoys but doesn’t need.

- 65% Investing: The majority of Gary’s income, a whopping 65%, goes toward investments. This includes stocks, real estate, and other assets that grow his wealth.

2. Everyday Joe

- 55% Needs: Joe uses a larger portion of his income, around 55%, on essential expenses.

- 40% Wants: Joe allocates 40% to non-essentials, spending much more on leisure and material items.

- 5% Investing: With only 5% left, Joe has little left for investments, limiting his potential for wealth growth.

Key Takeaways for Better Budgeting

- Minimize Spending on Wants

Millionaires prioritize investing over indulging in wants. By reducing your spending on non-essentials, you free up more money for investments. - Focus on Investment Growth

Investing isn’t just for the wealthy; it’s a habit that helps you become wealthy. Aim to set aside a significant portion of your income for assets that appreciate over time. - Live Below Your Means

Millionaires often live below their means. This doesn’t mean depriving yourself; it means being mindful of unnecessary expenses. - Make a Plan to Increase Investments Gradually

You may not start with 65% going to investments, but small changes can add up. Gradually increase your investment contributions as your income grows or as you reduce spending on wants. - Track and Adjust Regularly

Check your budget regularly. Are you spending too much on wants? Adjust and redirect more towards investments over time.

Resources

Books:

- Your Money or Your Life by Vicki Robin – A guide to transforming your financial life and focusing on what truly matters.

- The Millionaire Next Door by Thomas J. Stanley – Insights into the spending and saving habits of America’s wealthy.

Online Resources:

- Investopedia’s Guide to Budgeting – Learn more about the fundamentals of budgeting.

- Dave Ramsey’s Budgeting Tips – Practical advice for managing finances and building wealth.

By learning from millionaire habits, you can make smarter budgeting choices and work toward financial independence.