Introduction

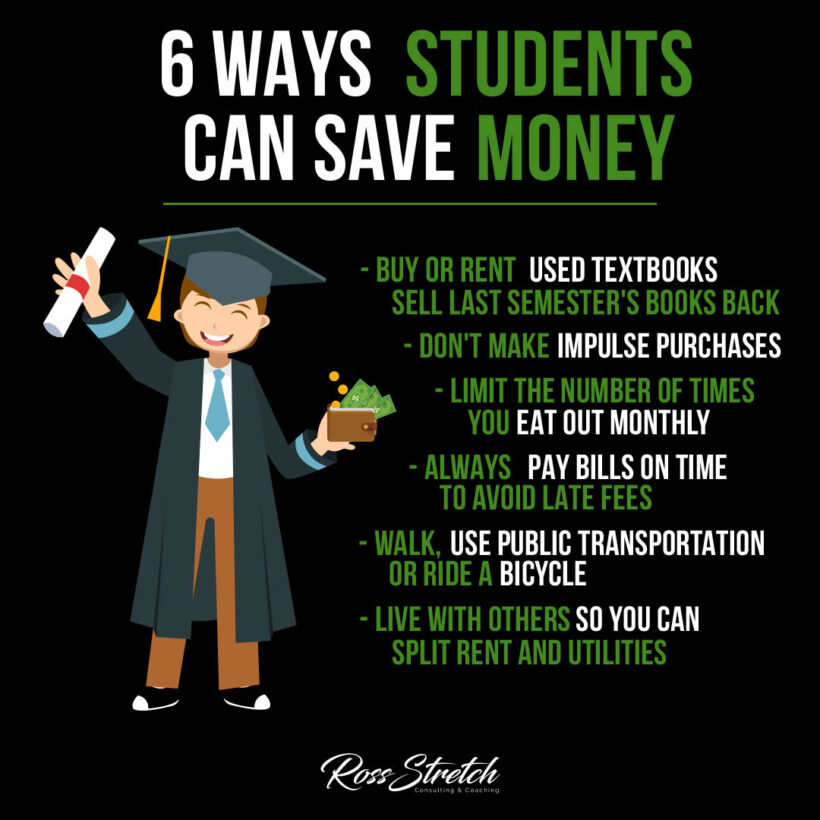

Being a student often means living on a tight budget. From textbooks to rent, expenses can add up quickly. But with a few smart choices, you can stretch your money further. Here are six practical ways students can save money without sacrificing too much comfort.

1. Buy or Rent Used Textbooks

Textbooks are one of the biggest expenses each semester, but you don’t have to buy them new. Here’s how you can save:

- Buy Used: Look for secondhand textbooks online or at campus bookstores. They’re often significantly cheaper.

- Rent Textbooks: Some websites and stores offer textbook rentals, which can save you a lot.

- Sell Last Semester’s Books: After finishing a class, sell your textbooks to get some of your money back.

2. Avoid Impulse Purchases

Impulse buying can drain your budget quickly. Try these tips to keep spending under control:

- Make a List: Write down what you need before shopping and stick to it.

- Wait 24 Hours: If you see something you want, wait a day before buying. Often, the desire to buy will fade.

- Budget for Extras: Set aside a small amount each month for treats so you can indulge occasionally without overspending.

3. Limit Eating Out

Eating out is convenient but can get expensive. Save money by:

- Cooking at Home: Preparing meals at home is usually cheaper and can be healthier.

- Plan Meals: Plan meals for the week to avoid last-minute takeout.

- Budget for Dining Out: If you like eating out, set a monthly limit and stick to it.

4. Always Pay Bills on Time

Late fees can add up quickly and waste your money. Here’s how to avoid them:

- Set Up Reminders: Use calendar alerts or apps to remind you of due dates.

- Automate Payments: If possible, set up automatic payments for consistent bills like rent and utilities.

- Check Your Accounts Regularly: Make sure you have enough funds to cover bills and avoid overdraft fees.

5. Use Public Transportation or Walk

Owning a car is costly, with expenses like gas, maintenance, and parking. Instead, consider:

- Walking or Biking: It’s free and good exercise.

- Public Transit: Many campuses offer student discounts on public transportation.

- Ride Sharing: Share rides with friends to split the cost of getting around.

6. Share Living Expenses with Roommates

Rent and utilities can be high, but sharing costs makes them more manageable. Here’s how:

- Find Roommates: Sharing rent with roommates is often much cheaper than living alone.

- Split Utilities: Divide the cost of internet, electricity, and other bills evenly.

- Create a Chore Schedule: Sharing responsibilities helps keep things fair and organized.

Conclusion

Saving money as a student may seem challenging, but small changes add up. By buying used textbooks, cooking more meals at home, and sharing living expenses, you can make the most of your budget. Start with these simple steps, and enjoy the peace of mind that comes with better financial management.