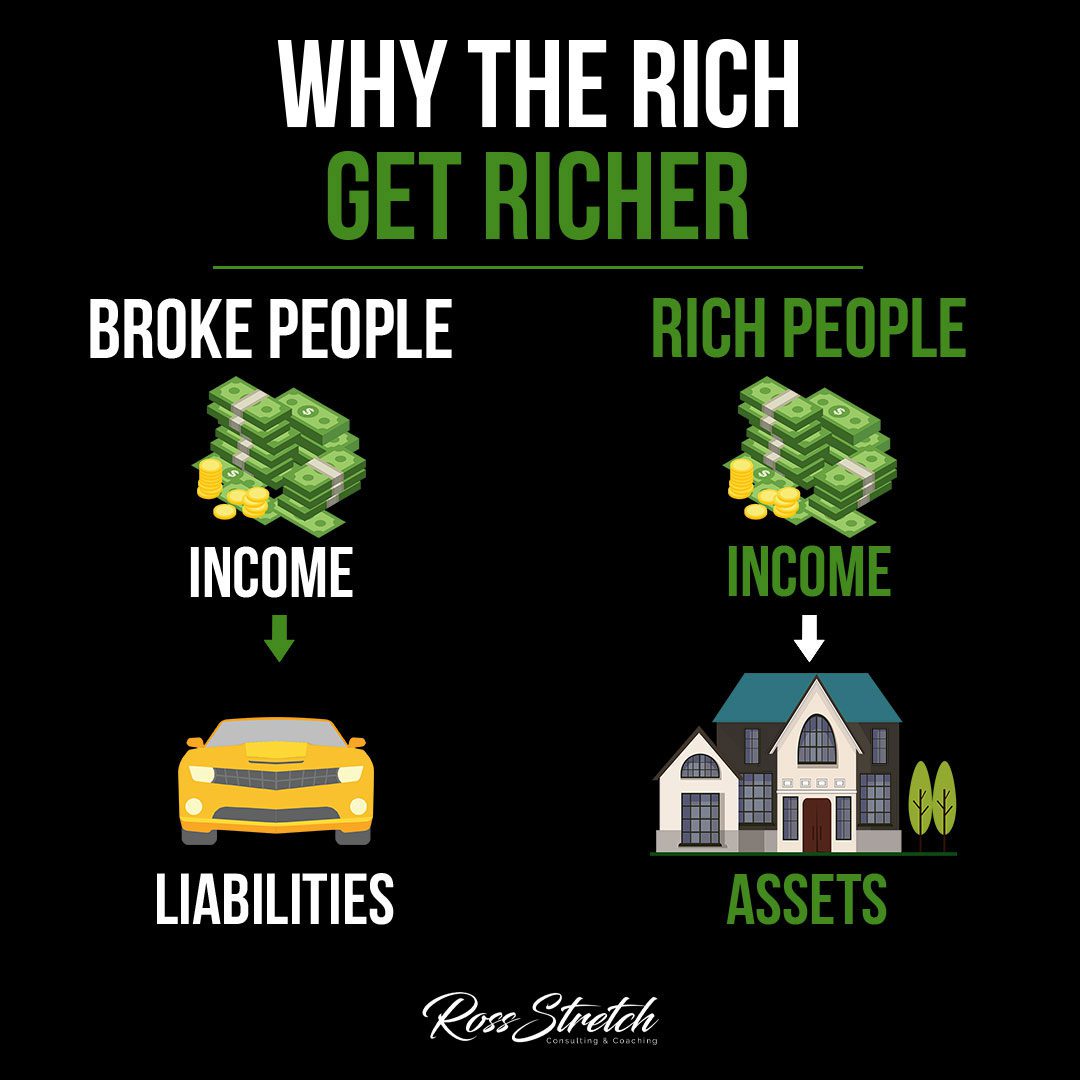

Broke People

Limited Income Potential

Broke individuals often face limited income potential due to various factors such as low-paying jobs, lack of educational opportunities, or limited access to resources. The inability to generate substantial income hinders their ability to accumulate wealth and break free from the cycle of financial struggle.

Burden of Liabilities

Broke individuals often carry a heavy burden of liabilities, such as debt from loans, mortgages, or credit cards. These liabilities consume a significant portion of their income, leaving little room for savings or investments. The constant need to meet financial obligations prevents them from building a strong financial foundation and hampers their ability to grow their wealth.

Financial literacy and education are also crucial in empowering individuals to make informed decisions and manage their finances effectively.

Ross Stretch

Rich People

High Income Potential

Rich individuals often enjoy higher income potential due to factors such as successful careers, entrepreneurship, or investment income. Their ability to generate substantial income provides them with a solid financial base, allowing for greater opportunities to accumulate wealth and pursue lucrative investment ventures.

Strategic Acquisition of Assets

Rich individuals understand the importance of acquiring assets that appreciate in value over time. They invest in income-generating assets such as real estate, stocks, or businesses. These assets contribute to their wealth accumulation by generating passive income and increasing in value, creating a snowball effect that propels their financial growth.

Income

Leveraging Multiple Income Streams

The rich often have multiple streams of income, diversifying their earnings and reducing dependence on a single source. They may earn through various channels such as salaries, investments, royalties, or business ventures. This diversified income approach provides stability and increased opportunities for wealth accumulation.

Focus on High-Income Opportunities

Wealthy individuals prioritize seeking out high-income opportunities. They may pursue lucrative careers in industries with high earning potential, invest in high-growth sectors, or create innovative businesses that generate substantial profits. By focusing on high-income opportunities, they maximize their earning potential and create a solid foundation for wealth creation.

Assets

Investing in Appreciating Assets

The rich understand the power of investing in assets that appreciate in value over time. They strategically allocate their resources to acquire assets such as real estate, stocks, or businesses that have the potential for growth and generate passive income. This smart investment approach contributes to their continuous wealth accumulation and financial stability.

Building Wealth through Compounding

Wealthy individuals harness the power of compounding to build their wealth. By reinvesting their earnings and returns from assets, they generate additional income that further fuels their financial growth. The compounding effect allows their wealth to grow exponentially over time, providing a significant advantage in accumulating riches.

In conclusion

The dynamics of income, assets, and liabilities play a significant role in the continuous accumulation of wealth by the rich. Their higher income potential, strategic acquisition of assets, diversified income streams, and focus on high-income opportunities contribute to their ongoing financial growth. On the other hand, the limited income potential and burden of liabilities faced by broke individuals create obstacles to wealth accumulation. Understanding these factors is crucial in addressing the wealth gap and promoting financial empowerment for all individuals.

By adopting strategies that enhance income potential, promote asset acquisition, and reduce liabilities, individuals can take steps towards improving their financial situations and working towards building wealth. It is important to focus on increasing income through various means, including exploring high-income opportunities and diversifying income streams. Additionally, investing in appreciating assets and leveraging the power of compounding can significantly contribute to long-term wealth accumulation.

To bridge the wealth gap, efforts should be made to provide equal access to education, resources, and opportunities that allow individuals to enhance their income potential and acquire assets. Financial literacy and education are also crucial in empowering individuals to make informed decisions and manage their finances effectively.

By addressing the underlying factors that contribute to the rich getting richer, such as income disparities and limited access to opportunities, society can strive towards a more equitable financial landscape. Emphasizing financial inclusion, providing support for entrepreneurship, and promoting policies that promote wealth creation for all can help create a more balanced and prosperous society.

In conclusion, the rich continue to accumulate wealth due to factors such as higher income potential, strategic asset acquisition, and diversified income streams. Understanding these dynamics can guide individuals in their pursuit of financial growth. By focusing on income generation, asset accumulation, and addressing systemic inequalities, we can work towards a society where wealth creation is accessible to all, reducing the wealth gap and fostering economic empowerment for everyone.