Introduction:

Earnings per share (EPS) is a key financial indicator that provides insights into a company’s profitability and financial performance. It is an important metric for investors and analysts to evaluate a company’s value and make informed investment decisions. In this article, we will delve into the concept of earnings per share, its calculation, and its significance in understanding a company’s financial health.

Understanding EPS and its calculation can help investors evaluate the attractiveness of a company’s stock and make informed investment decisions.

Ross Stretch

What is Earnings per Share (EPS)?

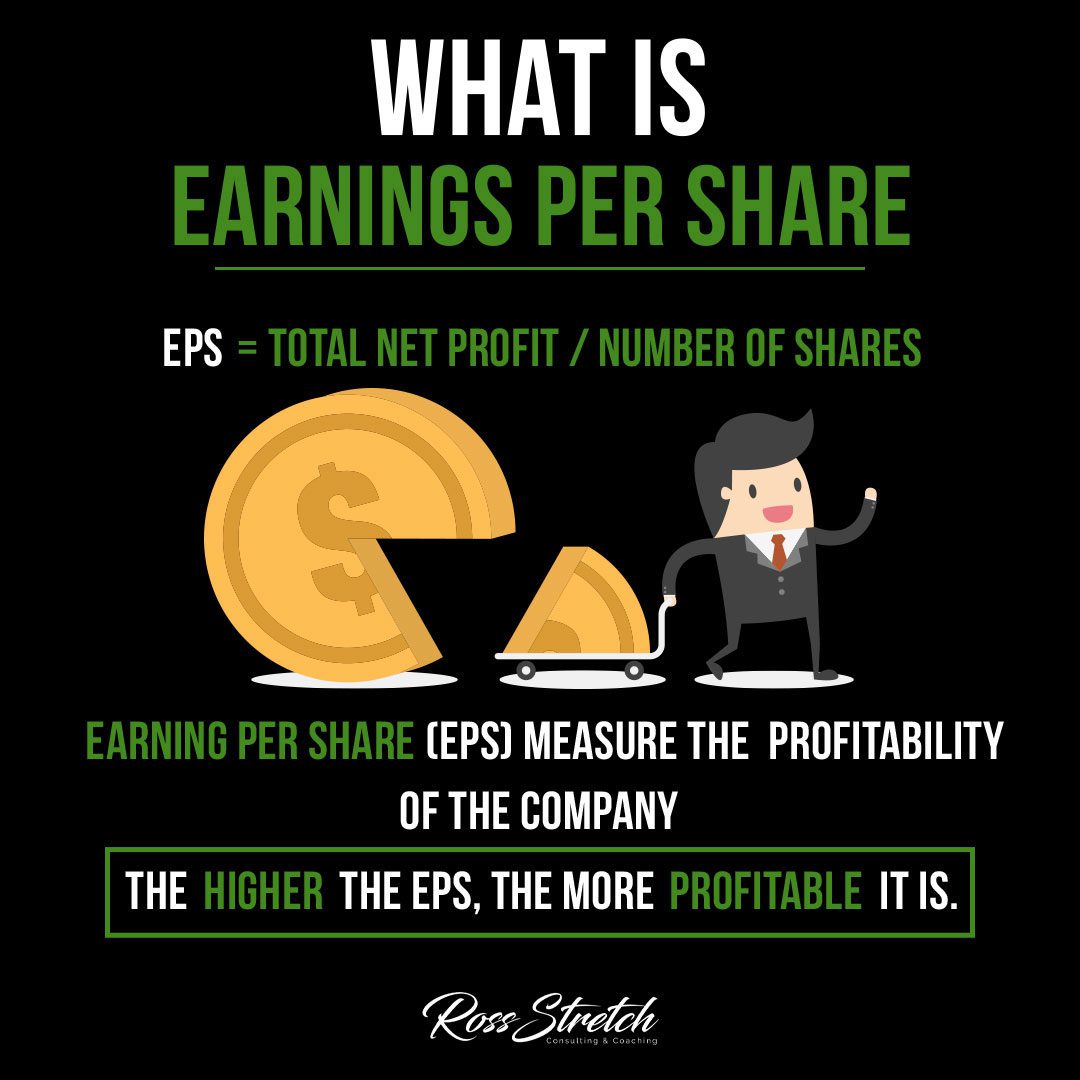

- Earnings per share (EPS) is a financial metric that measures the portion of a company’s profit allocated to each outstanding share of common stock.

- It indicates the profitability of a company on a per-share basis and provides a better understanding of its financial performance.

- EPS is a widely used metric in financial analysis and is often reported by companies in their financial statements and annual reports.

How is EPS Calculated?

- The basic formula to calculate earnings per share (EPS) is dividing the net income available to common shareholders by the weighted average number of outstanding shares during a specific period.

- The net income used in the calculation is typically the income attributable to common shareholders after deducting preferred stock dividends and any other non-common expenses.

- The weighted average number of outstanding shares takes into account any changes in the number of shares during the reporting period, such as stock splits, stock buybacks, or new issuances.

Significance of EPS in Investment Analysis

- EPS serves as a crucial factor for investors when evaluating a company’s financial health and performance.

- A higher EPS indicates that a company is generating more profits per share, which can be viewed positively by investors.

- Comparing the EPS of different companies within the same industry or sector can help identify which companies are more profitable and efficient.

- EPS is often used in valuation models, such as the price-to-earnings (P/E) ratio, to assess the attractiveness of a company’s stock price relative to its earnings.

Considerations for Interpreting EPS

- It is essential to consider the quality and sustainability of a company’s earnings when interpreting EPS. Temporary or non-recurring factors may impact the accuracy of EPS as a measure of long-term profitability.

- EPS should be analyzed in conjunction with other financial ratios and metrics to gain a comprehensive understanding of a company’s financial performance.

- EPS can vary significantly across industries, so it is crucial to compare companies within the same industry for more meaningful insights.

- Investors should also consider the growth rate of EPS over time to assess a company’s ability to generate consistent profits and potentially provide a return on investment.

Conclusion:

Earnings per share (EPS) is a fundamental financial metric that provides valuable insights into a company’s profitability and financial performance. Understanding EPS and its calculation can help investors evaluate the attractiveness of a company’s stock and make informed investment decisions. By considering EPS alongside other financial ratios and metrics, investors can gain a more comprehensive understanding of a company’s financial health and its potential for long-term success.

References:

- Investopedia. “Earnings Per Share (EPS).” [Link: https://www.investopedia.com/terms/e/eps.asp]

- The Balance. “How to Calculate Earnings Per Share (EPS).” [Link: https://www.thebalance.com/how-to-calculate-earnings-per-share-eps-357497]

- Corporate Finance Institute. “Earnings Per Share (EPS).” [Link: https://corporatefinanceinstitute.com/resources/knowledge/finance/earnings-per-share-eps/]