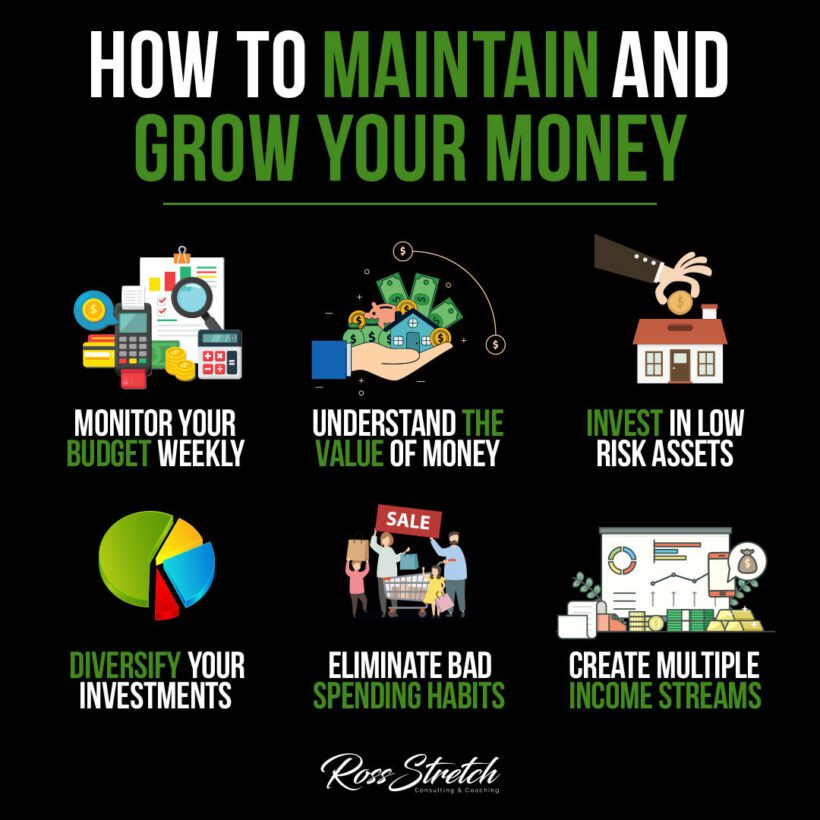

Navigating the world of personal finance can be daunting, but mastering the art of maintaining and growing your money is essential for long-term financial freedom. This comprehensive guide provides you with actionable strategies that can help you take control of your finances and set the stage for a prosperous future.

Weekly Budget Monitoring: Your Financial Health Check

Regularly tracking your spending is like having a weekly health check for your finances. It allows you to stay on top of your expenditures and make adjustments as needed. This habit ensures you’re not overspending and that your money is being allocated to the right places. Tools like budgeting apps or spreadsheets can be instrumental in monitoring your budget effectively.

Understanding Money’s True Value

To grow your wealth, you must first understand the value of money. Recognizing that each dollar spent could have been invested means acknowledging the potential for growth that was lost. This mindset encourages smarter spending and a greater appreciation for saving and investing, leading to more informed financial decisions.

Investing in Low-Risk Assets for Stability

Investing in low-risk assets is a prudent way to maintain your money. These investments may include bonds, index funds, or high-yield savings accounts. The goal is to earn steady returns while preserving capital, providing a safety net for your financial portfolio.

Eliminating Poor Spending Habits

Bad spending habits can be the Achilles’ heel of financial growth. Cutting out unnecessary expenses and impulse purchases will help you save more and invest more. Adopting a frugal lifestyle doesn’t mean living without—it means spending wisely and valuing quality over quantity.

Diversifying Investments to Mitigate Risks

Diversification is key to a resilient investment strategy. Spreading your investments across different asset classes and sectors can protect you from market volatility and reduce the overall risk of your portfolio. This approach can help ensure that a loss in one area doesn’t derail your entire financial plan.

Creating Multiple Streams of Income

Relying on a single source of income is a risky financial strategy. Creating multiple income streams can provide financial security and opportunities for money growth. This could mean taking on a side job, starting a business, or investing in income-generating assets like real estate.

Balancing Risk and Reward

Understanding your risk tolerance is crucial when it comes to investing. Balancing the potential rewards against the risks involved can help you make investment choices that align with your financial goals and comfort level.

In Conclusion: Building a Financially Sound Future

By incorporating these strategies into your financial planning, you can not only maintain your current wealth but also create opportunities for growth. Discipline, knowledge, and a proactive approach are the keys to navigating the financial landscape successfully.